Discover the Best Wealth Management Tools

According to Statista, the wealth management market is expected to see assets under its management reach an estimated value of $122.20 trillion in 2023. Wealth management tools have become common due to the increasing complexity of personal finance, technological advancements, data aggregation capabilities, automation, personalization, cost efficiency, and changing demographics. These tools offer individuals a convenient and accessible way to manage their wealth and achieve their financial goals.

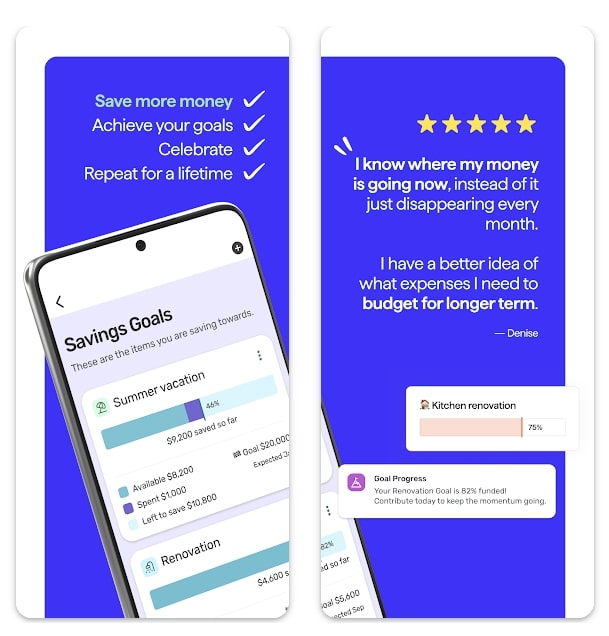

Quicken

Quicken is a personal finance management application that has been rapidly gaining popularity due to its user-friendly interface. It offers a range of financial management tools, including budgeting, investment tracking, and bill management features, allowing users to review their portfolio performance during past economic downturns and anticipate potential outcomes if the next recession mirrors past ones.

Quicken’s range of powerful money management tools, such as expense tracking, investment management, and rental property management, helps users stay within budget, monitor bills, and manage investments effectively.

The tool offers the functionality to generate customized invoices and categorize income and expenses into personal, business, and rental categories, enhancing its capabilities as an all-around personal finance solution.

Image source: Google Play

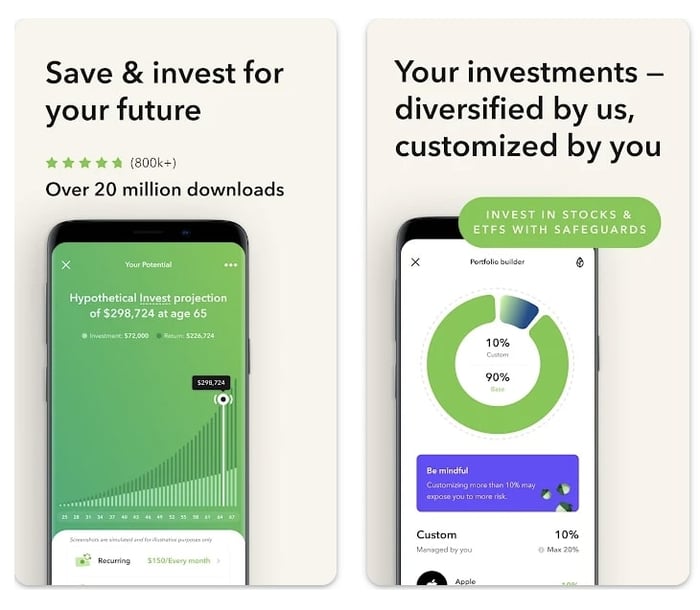

Acorns

Acorns specializes in the concept of micro-investing, which means it allows users to invest small amounts of money. The app rounds up their everyday purchases to the nearest dollar and invests the spare change. For example, if you buy a coffee for $3.50, Acorns would round up the purchase to $4.00 and invest the remaining $0.50. Acorns supports users in their financial planning by automating investments and helping them grow their portfolios over time. It’s an excellent option for those who want to start investing with small amounts.

Acorns can set up automatic recurring investments on a daily, weekly, or monthly basis. This feature helps users consistently grow their investments over time without having to think about it.

Last but not least, the app is user-friendly and accessible, making it easy for individuals who might be new to investing to get started. The app is available on both iOS and Android devices.

Image source: Google Play

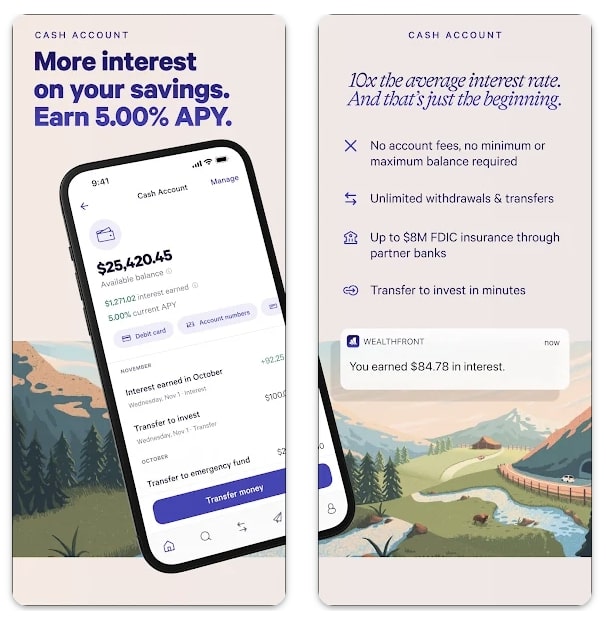

Wealthfront

Wealthfront is a robo-advisor that uses advanced investment management software solutions to automate and optimize users' investment portfolios. It offers low-cost ETF portfolios and automated rebalancing. It’s a great option for hands-off investors. Wealthfront’s primary function is to provide automated investment management. After a user creates an account and answers a series of questions about their financial goals, risk tolerance, and time horizon, Wealthfront’s algorithm builds and manages a diversified investment portfolio for them.

The apps’ key characteristics:

-

Passive investment strategy: Wealthfront follows a passive investment strategy, which means it focuses on building and maintaining a portfolio designed to achieve long-term goals. It uses Modern Portfolio Theory and aims to maximize returns for a given level of risk.

-

No minimum investment: One of the advantages of Wealthfront is that it doesn’t have a minimum investment requirement, making it accessible to investors with various levels of financial resources.

-

Portfolio rebalancing: The platform automatically rebalances when the user’s portfolio drifts from its target allocation. This helps the investors maintain their desired level of risk and return.

Image source: Google Play

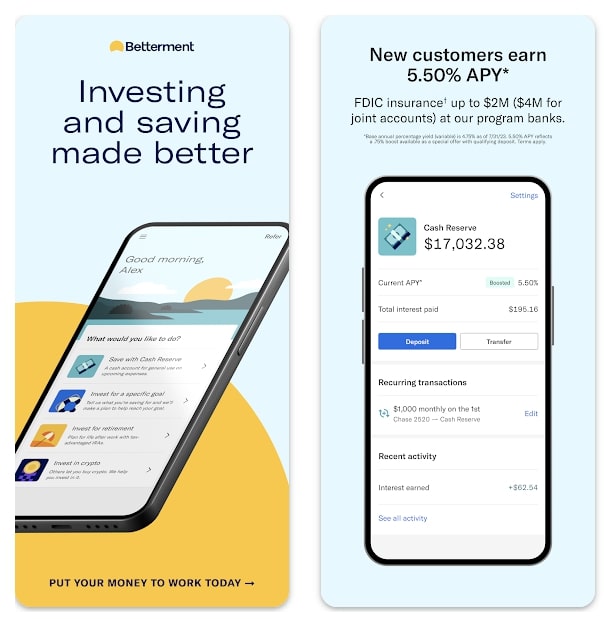

Betterment

Betterment is another robo-advisor that provides automated investment management. Its tools offer solutions aiding financial advisors, enabling them to provide better services to their clients. It’s known for its user-friendly interface and goal-based investing, making it easy for individuals to save and invest for specific financial goals.

Image source: Google Play

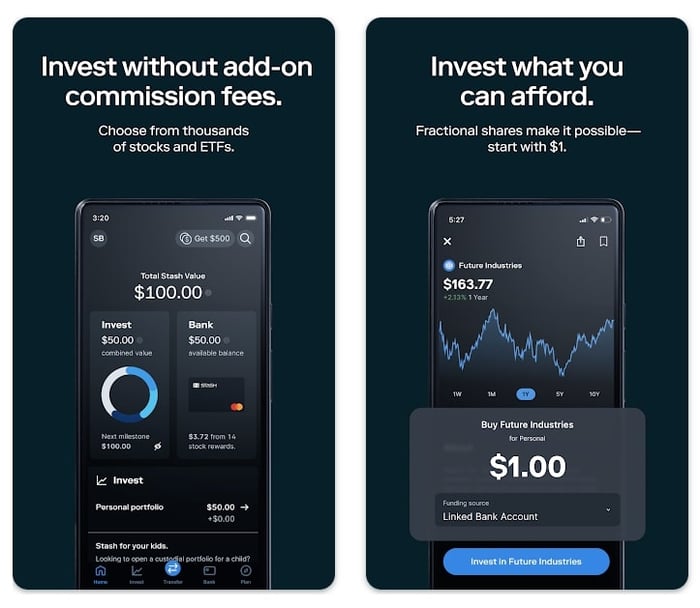

Stash

Stash might be a good choice for individuals who are looking for an intuitive platform to begin their investment journey. Its emphasis on education, customizable portfolios, and low-cost investing options makes it a suitable option for those who want to align their investments with their personal values and learn about financial markets in the process. Stash's customizable portfolios and educational resources also make it a valuable tool for wealth management companies looking to attract new investors.

Stash allows users to invest in individual stocks and exchange-traded funds (ETFs). Unlike some other investment platforms that require users to purchase whole shares of stocks, Stash enables people to buy fractional shares. This means they can invest in high-priced stocks with a small amount of money, making it accessible to users with limited capital.

Stash offers users the ability to set up recurring automatic investments, helping them build their portfolios over time. This can be beneficial for those who want to invest consistently and steadily.

Image source: Google Play

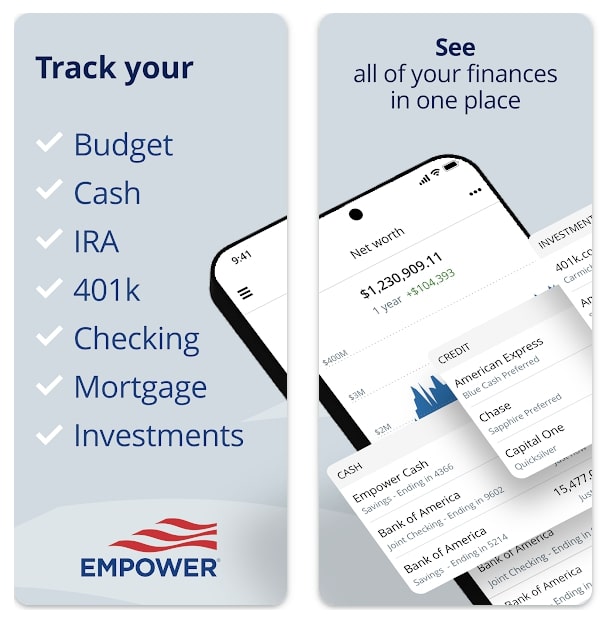

Empower

Empower, formerly known as Personal Capital, is a comprehensive financial app that provides a wide range of tools and services to help individuals manage their money, investments, and financial goals.

Empower allows users to link and aggregate all their financial accounts, including bank accounts, credit cards, loans, investments, and retirement accounts. This integration functions similarly to customer relationship management systems, giving users a holistic view of their entire financial landscape, making it easier to track income, spending, and net worth.

The app helps users manage and pay down debt by providing insights into loan balances, interest rates, and payment schedules. It can suggest strategies to reduce one’s debt and improve their overall financial health.

Image source: Google Play

How To Choose the Right Wealth Management Tool?

Selecting the appropriate wealth management tool can significantly impact your financial success, so it is essential to choose one that aligns with your specific goals and demographic needs. These tools can also be beneficial for financial advisors in providing better services to their clients.

For young professionals just starting their financial journey, tools like Acorns or Stash can be particularly advantageous. These platforms allow beginners to invest small amounts and learn about the markets with minimal risk. Acorns, with its micro-investing approach, makes it easy to grow investments incrementally without requiring substantial upfront capital. On the other hand, Stash provides extensive educational resources and the option to invest in fractional shares, making it accessible and informative for those new to investing.

For families aiming to balance multiple financial goals, Quicken and Empower offer comprehensive features. Quicken excels in budgeting and bill management, helping families track expenses and stay on top of their finances. It is an all-encompassing tool that can manage personal, business, and rental property finances, making it ideal for households with diverse financial activities. Empower (formerly Personal Capital) aggregates all financial accounts, providing a holistic view of the family’s economic health. Its robust budgeting tools and retirement planning advice make planning easier for future expenses and long-term goals.

Retirees or those nearing retirement might find Wealthfront and Betterment particularly beneficial due to their automated investment management and retirement planning features. Wealthfront offers personalized portfolios based on risk tolerance and time horizon, ensuring that investments are aligned with long-term retirement plans. Its automated rebalancing and tax-loss harvesting features help maintain an optimal investment strategy. Betterment, known for its goal-based investing, assists retirees in managing their portfolios to meet specific retirement goals while minimizing risk and maximizing returns through smart, automated strategies.

By understanding your financial objectives and considering the unique features each tool offers, you can select the wealth management tool that best supports the journey toward economic stability and growth.

Summary

Wealth management tools gain increasing traction in the wealth management industry. It comes as no surprise as, selecting the right wealth management tool can help effectively manage and grow personal wealth or assist clients in achieving their financial goals. By understanding the importance of wealth management, assessing financial goals, comparing features and functionality, and considering pricing and support options, consumers can make an informed decision and choose the best tool for their needs.