KYC: 4 Verification Tools for Banking

The KYC process is a vital aspect of the banking industry, providing financial institutions with the means to check customer identities, maintain regulatory compliance, and reduce potential money laundering risks throughout their journey. Its use enables them to adhere to AML (anti-money laundering) and CDD (customer due diligence) regulations, benefiting both their reputation and protection against monetary losses.

Financial institutions utilize identity verification tools like document checks, biometrics, and data validation to combat financial crimes and protect customer identities while minimizing losses. Effective risk management, achieved through continuous monitoring of accounts and transactions, allows timely detection of suspicious activity, enhancing the ability to make informed decisions for the bank's and customers' security.

Key takeaways

- KYC verification is essential for banks to ensure regulatory compliance, reduce fraud risks, and protect their reputation.

- Top KYC solutions, such as Veriff, Onfido, and Trulioo, provide comprehensive customer verification processes.

- Banks must analyze technology, features, and pricing when selecting the right solution to maximize benefits while balancing compliance with customer experience.

Here we will discuss why KYC verification is essential, what types of tools are available, the best KYC solutions for banks and where this technology may be heading within the industry.

Types of KYC verification tools

Statista soughtinsights from industry expertsregarding the anticipated impact of emerging technologies on the wealth management sector in Europe until 2025. Customer data management tools (CRM) and know-your-customer (KYC)/anti-money laundering (AML) technology, already widely adopted by global financial firms, are expected to exert a more significant influence on wealth management operations.

These tools play a crucial role in various daily tasks, including client onboarding and account maintenance.

Identity verification holds paramount importance in information security, ensuring that only individuals with genuine authorization can access sensitive data and protecting it from harmful or malicious intrusions. Projections indicate substantial growth in global expenditure on identity verification, with spending expected to surge from 4.93 billion in 2017 to over 18 billion in 2027, reflecting a 10-year span.

The rise in identity theft occurrences and the escalating threat of fraudsters infiltrating business networks, apps, or services act as major drivers for the market's expansion. Additionally, stringent government regulations regarding privacy and the increasing push for digitization will contribute to the heightened demand for such products in the future.

To ensure customer authenticity and mitigate the risk of fraud or money laundering, banks can leverage three main types of KYC verification tools.

Document verification

Document validation in KYC is the process of verifying the authenticity of documents submitted by a customer to comply with regulatory requirements and prevent fraud. This includes validating the document type, ensuring it is not expired or altered, and cross-checking the information with other data sources.

Document validation plays a crucial role in the KYC process, allowing banks to authenticate customers' identity and address by examining documents such as driver's licenses, passports, or proof of residence.

With advanced technologies verifying document validity, extracting information with Optical Character Recognition (OCR) software, and comparing it to the provided details, this procedure ensures accurate customer verification.

Incorporating innovative verification tools for documentation enables banks to enhance customer onboarding processes while reducing associated risks during new account setup, ensuring compliance with regulations.

This approach brings multiple benefits, including improved security, fraud prevention, and an enhanced consumer experience through fast confirmation, avoiding errors and effectively adhering to established standards.

Biometric authentication

Biometric authentication systems offer financial institutions and their customers enhanced security and convenience by relying on specific biological traits like fingerprints or facial recognition for robust identity confirmation. While challenging to replicate biometrically, implementing this technology may require substantial investments in specialized hardware and software.

Despite the potential challenges, such as the risk of theft or data leakage leading to identity fraud, banks are likely to persist in integrating biometric tools into KYC verification processes. The priority remains on achieving increased levels of safety and user comfort, outweighing potential obstacles in the pursuit of an enhanced customer experience.

In 2020,the global market for biometric authentication and identification surpassed a value of 3.5 billion U.S. dollars, primarily propelled by government bodies and border management entities. Projections suggest that by 2026, the global authentication and identification market is poised to reach nearly 8.8 billion U.S. dollars. During this period, banking and financial institutions are expected to contribute over two billion U.S. dollars as end users.

Data validation and risk scoring

The use of data validation and risk scoring tools in KYC verification is crucial to ensuring the accuracy, completeness, and consistency of customer information, as well as assessing associated risks. This enables banks to make informed decisions while complying with regulatory requirements related to fraud detection or money laundering prevention by monitoring customer transactions.

These tools offer a practical means for financial institutions to implement efficient risk management measures, ensuring the effective establishment of secure KYC procedures. Consequently, their integration into banking processes significantly enhances security levels when handling customer data associated with such activities.

Integrating KYC verification tools with banking systems

Integrating KYC verification systems with banking programs brings various benefits, including simplified customer onboarding and automated tracking of compliance. Coupling this software with other applications offers banks the advantage of streamlined new customer sign-ups while reducing associated risks.

Itensures secure storage for customer data, accurately authenticating their identities and defending against financial losses, providing customers assurance in the process. As digitalization increases among many financial institutions, successful integration between KYC tools within these organizations is key to regulatory obedience and security regarding transactions made by them online or otherwise.

Top KYC verification solutions for banking

When selecting the best option for your institution's system, it is crucial to consider aspects such as cost-efficiency, the functionality offered by each vendor, and how easily they can be implemented within current infrastructure models to ensure successful operation results after deployment. Assessing the security of your data with a particular tool should also play an integral role in choosing the best option for your organization.

There are providers that offer features and integration tailored towards banking needs, such as Veriff, Onfido, and Trulioo, among others. Their services aim to fortify compliance efforts while simultaneously improving customer experience through reliable fraud reduction methods and streamlined authentication processes.

1. Veriff

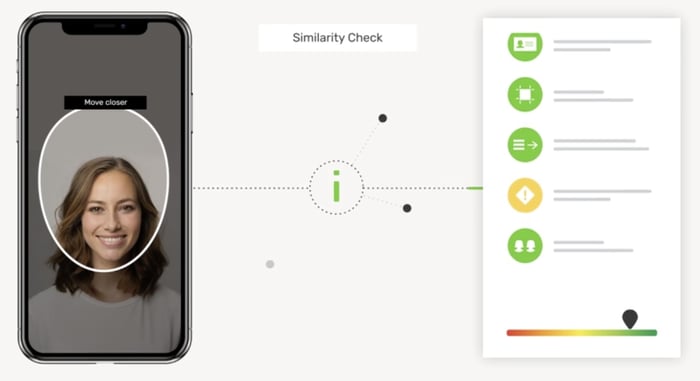

Veriff provides KYC solutions utilizing facial recognition and image capturing technology to combat fraud and expedite the onboarding of valuable customers. Leveraging Veriff's capabilities allows banks to optimize their customer onboarding process, ensuring compliance with regulatory requirements while implementing identity verification measures for additional protection against financial losses.

Image source: Veriff

Veriff's pioneering system ensures a more secure experience when onboarding new clients, providing companies with greater peace of mind in safeguarding operations against fraudulent activity. It also facilitates essential tasks like authentication quickly and without compromising accuracy or convenience during the onboarding process.

2. Onfido

Onfido's Real Identity Platform, introduced in 2022, is a comprehensive system offering secure customer acquisition and identity verification. By combining trusted data sources endorsed by authorities with biometric verifications and fraud detection signals, the platform ensures the accurate verification of consumer identities while preventing fraudulent activity.

Image source: Onfido

Utilizing Onfido's digital solutions for identification authentication enables banks to enhance their compliance processes and mitigate the risk of financial loss from unscrupulous activities. This advanced technology allows for the accurate confirmation of the legitimacy of customers' identities, preventing costly damage before it occurs.

3. Trulioo

Trulioo is a global identity verification firm that provides secure access to over 400 data sources worldwide, enabling quick verification of individuals and companies. They offer an integrated platform for customer identification programs, business authentication procedures, AML/KYC checks, and address verifications, creating comprehensive yet efficient identity confirmation processes through reliable identity providers operating on their secure digital network.

Image source: Trulioo

By harnessing the power of Trulioo's unified system, banks can streamline their onboarding process while consistently adhering to regulatory obligations. This approach not only ensures regulatory compliance but also safeguards operations from potential financial damages arising from detected fraudulent acts.

Trulioo's accurate recognition of customers' identities within its highly protective digital environment provides a secure onboarding journey, supported by comprehensive security measures and robust vetting methods accessible securely from anywhere in the world, whenever needed.

4. Jumio

Jumio stands out as a leading provider of AI-powered identity verification solutions for banks and other financial institutions. Their offerings encompass a variety of KYC services, including ID document verification, facial recognition, and biometric authentication.

Image source: Jumio

Jumio's ID document verification service empowers banks to authenticate government-issued IDs, including passports, driver's licenses, and national IDs. Utilizing computer vision and machine learning, the system extracts data from the ID document and compares it to the user's selfie, confirming the user's identity.

Beyond document verification, Jumio provides facial recognition and biometric authentication. Facial recognition compares a user's selfie to the photo on their ID document to confirm identity, while biometric authentication utilizes unique physical characteristics, such as fingerprints or facial features, for identity verification.

The future of KYC solutions

In the dynamic realm of KYC tools, the future appears intricately linked to the transformative potential of blockchain technology. As companies aim to streamline identity management, combat fraud, and adhere to AML regulations, blockchain emerges as a prospective frontrunner in the coming years. The decentralized nature of blockchain not only bolsters security but also establishes a transparent and traceable framework.

Various industry players are exploring blockchain to revolutionize KYC processes. Through blockchain, companies seek to cut costs linked to traditional KYC solutions, fostering a more efficient, secure, and seamless verification process. While not yet ready for widespread adoption, the potential is unmistakable. The shift towards decentralization aligns with a broader technological trend, emphasizing user control and data privacy.

The adoption of blockchain in KYC processes promises enhanced data security, streamlined verification, cost reduction, fraud prevention, auditable record trails, legal compliance, automated workflows, and improved accessibility. This marks a substantial advancement in overcoming the limitations of conventional identity management systems.

Summary

In the pursuit of elevating both security and convenience for customers, banks are increasingly turning to AI, machine learning, and biometric technologies in the realm of KYC verification. This shift promises not only streamlined customer onboarding processes but also automated compliance monitoring, fostering an improved, secure, and efficient banking system.

The demand for advanced tools that strike a balance between compliance requirements and optimal user experience underscores the importance for financial institutions to stay abreast of modern technology trends. This proactive approach is crucial in safeguarding against operational risks and potential breaches of trust with clients, ensuring that banks can adapt and thrive in an ever-evolving financial landscape.