Future of Wealth Management: Top Trends to Watch in 2024

Wealth management encompasses personalized financial services aimed at strategically managing and optimizing an individual's or entity's assets and investments, while robo-advisory services cater to a distinct clientele by offering automated, algorithm-driven investment recommendations and portfolio management.

In this blog post, we will explore the top trends to watch in 2024 that might help you navigate the ever-changing world of wealth management:

- Wealth management is evolving with personalized services and sustainable investments.

- The new generation of investors, "Re-wired investor", approaches financial advice in a distinct manner compared to previous generations and anticipates a different mode of interaction with their advisors.

- Big data & analytics plus robo advisors offer cost effective solutions to a wider range of clients.

Personalized wealth management

Personalized wealth management is becoming increasingly important as clients seek tailored strategies and services to meet their unique financial goals and needs. These services are designed to address the full financial picture of high net worth individuals, taking into account their risk tolerance, investment preferences, and long-term goals.

According to Deloitte’s Disruptive trends in wealth management. An industry in change, investors seek comprehensive guidance that addresses a range of objectives, which may sometimes be contradictory, by utilizing diverse investment approaches and funding strategies. As a result, many wealth managers focus on providing them with a holistic approach to wealth management.

Previously, financial advisors primarily concentrated on providing investment advice, such as determining portfolio allocations, selecting individual stocks, and recommending mutual funds. They aimed to convince clients of their capability to generate superior investment returns.

However, investment advice has now become predominantly standardized, especially for clients in the mass market or emerging affluent segment. Many wealth management firms find themselves in this situation.

Private wealth managers, such as certified financial planners and registered investment advisors, work closely with clients to develop and implement customized investment strategies. They leverage their expertise in asset allocation, tax advice, and philanthropic planning to provide advice tailored to the unique needs and preferences of each client.

Private wealth advisors can help these clients navigate the intricacies of their financial lives, including:

- Tax planning

- Estate planning

- Investment advisory services

- Legal matters

Multi-generational wealth transfer

The multi-generational wealth transfer trend highlights the need for wealth managers to adapt their services to cater to the varying needs of different generations, particularly as baby boomers pass on their wealth to younger generations.

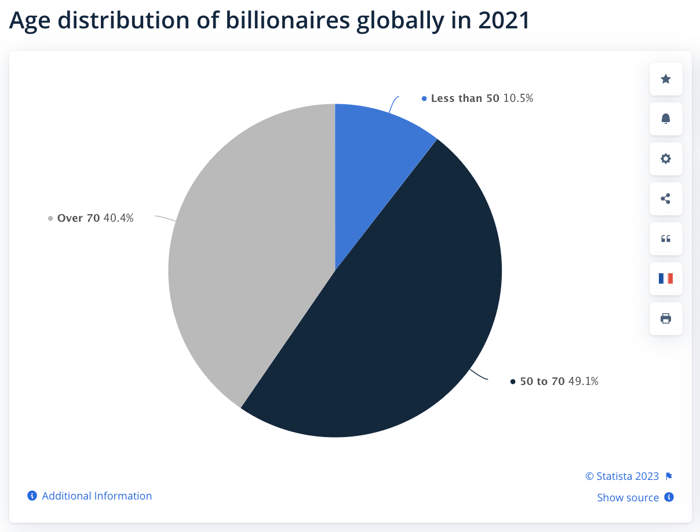

According to the Statista report Age distribution of billionaires globally in 2021, out of the 3,311 billionaires globally in 2021, around 50% fell within the age range of 50 to 70 years, with an additional 40% being aged over 70, while merely 10% were below 50 years old.

The cited statistic regarding billionaire age distribution further reinforces the idea that a significant portion of wealth is shifting from older individuals to those between 50 and 70 years old, reinforcing the need for adaptive wealth management strategies.

Image source: Statista

The research firm Cerulli Associates explains the importance of next gen service by the projections that the Generation X cohort, aged 40 to 55, is expected to receive an inheritance of approximately $30 trillion over the next 25 years.

Similarly, Millennials, aged 24 to 39, are estimated to inherit over $27 trillion. Cerulli also suggests that by the mid-2030s, Gen X households could be receiving an annual inheritance amounting to as much as $1.5 trillion.

All-in-one place convenience service necessitates an awareness of the distinct financial objectives and investment management approaches that may be suitable for each generation.

Multi-generational wealth transfer strategies may involve:

- Estate planning

- Inheritance planning

- Trust planning

- Other private wealth management strategies

These strategies can facilitate the transfer of wealth in a way that is advantageous to all generations involved. For example, tax loss harvesting can help minimize the tax implications of transferring assets between generations.

New generation of investors

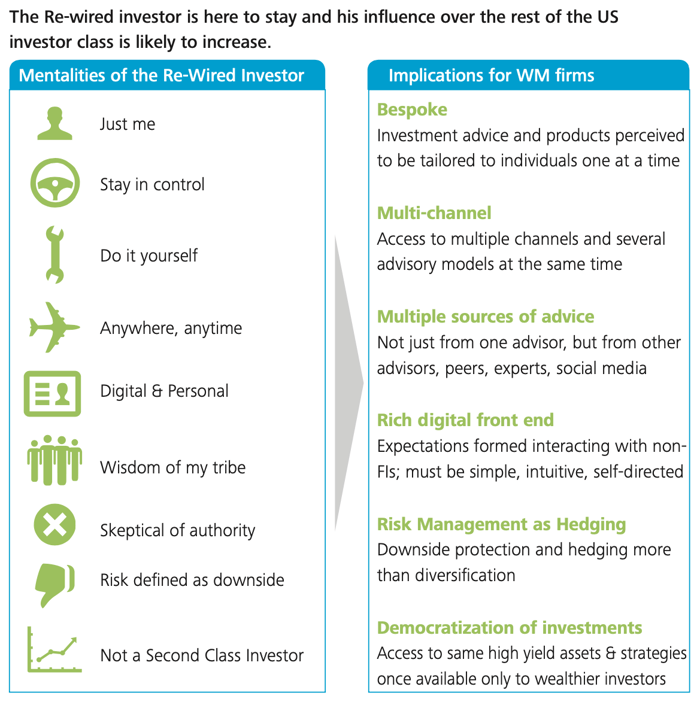

Deloitte employs the term to describe a fresh mindset, set of principles, and expectations exhibited by a new wave of investors. This group encompasses not only Generation X and Generation Y2 investors but also includes baby boomers who have been influenced by the attitudes and behaviors of their younger counterparts.

The Re-wired investor approaches financial advice in a distinct manner compared to previous generations and anticipates a different mode of interaction with their advisors. Rather than being treated as a generalized segment, these investors desire personalized attention as unique individuals ("Just me") with specific objectives and preferences. They seek advice tailored to their individual circumstances.

Additionally, they prefer to maintain control over their financial lives, comprehending the advice they receive, and making important decisions independently. They display reluctance towards purchasing discretionary services and are progressively comfortable conducting their own research.

Deloitte: 10 Disruptive trends in wealth management

The new investors are reshaping the wealth management industry with their preferences for technology, sustainability, and social impact.

According to the Statista report: Alternative investments among wealth management clients worldwide 2021, generation X represented the largest segment of mass affluent investors who utilized alternative investments.

However, it is the millennial generation that shows the most significant potential for future usage of alternatives. While approximately one-third of affluent millennials currently incorporated alternatives into their investment portfolios in 2021, 60 percent of them recognized the future potential and opportunity for utilizing such investments.

Sustainable investing

Sustainable investing is gaining traction as moreinvestors prioritize environmental, social, and governance (ESG) factors in their investment decisions. This investment approach incorporates ESG criteria into portfolio construction, offering ESG-focused products, and providing ESG-related advice.

The growing popularity of sustainable investing can be attributed to investors placing greater emphasis on sustainability considerations when making investment decisions. This is particularly relevant for millennial investors who have shown a heightened sensitivity to social and environmental issues.

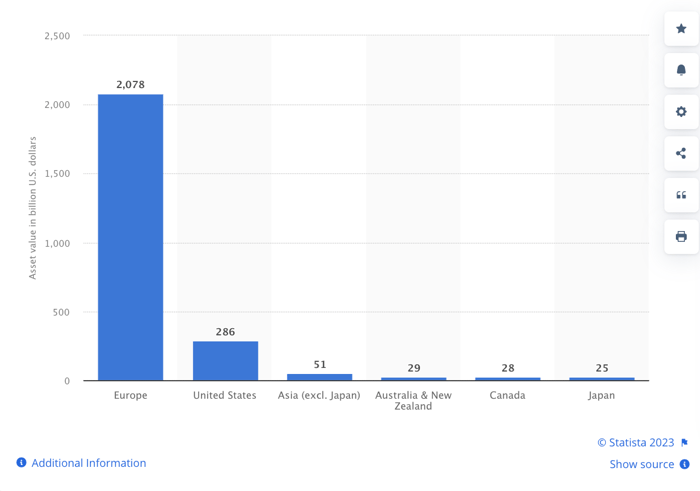

The report Assets of sustainable funds worldwide Q4 2022 by region shows that by the end of the last quarter of 2022, European sustainable funds managed a total of over two trillion U.S. dollars in sustainable assets. This amount surpasses the value of sustainable funds in the United States by more than 10-fold.

Additionally, Asia (excluding Japan) emerged as the third-largest region in terms of sustainable fund assets, with a total exceeding 50 billion U.S. dollars by 2022.

Image source: Statista

Statista estimates that by 2025 the share of sustainability invested assets among investors will reach 47% in Europe, Middle East and Africa. Yet, it should be noted that inconsistency and lack of reliable data from companies pose a barrier to investment. The respondents participating in the study claim that the biggest barrier are:

- The challenges around data quality and consistency (39%)

- Inconsistent data across classes (38%)

- Conflicting ESG ratings (28%)

Big data and advanced analytics

The majority of wealth management (WM) firms utilize relatively straightforward analytics derived from management information systems (MIS) and reporting systems. These analytics serve to provide essential business insights regarding client segments, advisor portfolios, product utilization, and the effectiveness of training programs.

However, Deloitte anticipates witnessing the evolution of firms towards adopting more comprehensive and advanced descriptive and predictive analytics. This transformation involves leveraging a combination of internal and external data, both structured and unstructured, to generate more comprehensive and insightful client profiles. It is expected that wealth management sector can take advantage of the following analytic capabilities:

- Algorithmic: Activities tracking, adjusting companies’ responses in real time

- Predictive: Developing data-centric guidance to make informed decisions amidst unpredictable circumstances

- Descriptive: Enhancing comprehension of the impact on business and customer reactions

- Reporting: Overseeing the day-to-day financial and operational performance

Big data and advanced analytics play a significant role in wealth management, allowing firms to:

- Make more informed choices;

- Provide more effective services to their clients.

- Enhance decision-making;

- Improve client outcomes;

- Increase efficiency in their practice.

However, the utilization of big data and advanced analytics in wealth management may present challenges such as the complexity of data, the requirement of specialized skills, and the cost of implementing technology.

Robo-advisors

A Robo-Advisor is a category of financial advisor that employs computer algorithms to deliver automated investment advice and handle client portfolios.

Robo-advisors are becoming more popular as an alternative to traditional wealth management services, offering cost-effective, automated investment management solutions for a wider range of clients.

These automated trading systems utilize an investment strategy as prescribed by an investment advisory service, making them a suitable choice for those who wish to manage their finances but lack the time or expertise to do so efficiently.

One of the key advantages of employing a robo-advisor is the cost savings. Robo-advisors typically charge far less than 1% per year of assets under management, making them an affordable option for those seeking wealth management services.

By offering a more cost-effective solution, robo-advisors have the potential to attract clients who may have previously been priced out of traditional wealth management services.

Here are some statistics conforming the robo-advisor trend:

- By 2023, it is estimated that the total assets under management in the Robo-Advisors market will amount to approximately US$2.76 trillion.

- The Robo-Advisors market is projected to witness a substantial increase in the number of users, reaching approximately 234.30 million users by the year 2027.

- In 2023, it is anticipated that the average assets under management per user within the Robo-Advisors market will be around US$8.05 thousand.

- Millennials are twice as inclined as Baby Boomers to utilize robo-advising services, and this market is projected to reach a value of $1.2 trillion by 2024.

Summary

In conclusion, the future of wealth management is shaped by a myriad of trends, including personalized services, multi-generational wealth transfer, the preferences of millennial investors, sustainable investing.

By staying informed about these trends and adapting their strategies and offerings accordingly, wealth managers can continue to provide exceptional services that cater to the evolving needs of their clients. As we move into 2024, the wealth management industry will continue to evolve, and those who embrace change will be well-positioned to succeed.