What Is Proptech and How It Drives Real Estate

Real estate stands as one of the most asset-heavy industries, playing a central role in the global economy with an estimated value of approximately $ 614 trillion.

However, with size often comes reluctance to change. For years the real estate sector has been hesitant to embrace technological advancements, earning its reputation as one of the least technologized industries worldwide. Those times are long gone.

Real estate companies see the need for digital acceleration and are embracing proptech as the key solution to address productivity and profitability challenges.

What is proptech – definition

Proptech stands for property technology. These are all the tech tools used in the real estate sector to research, market, buy, sell, and manage properties.

The goal of proptech is to optimize real estate transactions, boost operational efficiency, and elevate the overall experience for buyers, sellers, renters, agents, and property managers alike.

“Proptech is wide-ranging, continuously evolving and ripe with opportunities. Whether it’s installing smart thermostats or offering digital rent payment options, commercial real estate owners and investors can use proptech to make better-informed decisions, operate their buildings more efficiently and gain a competitive advantage.”

Al Brooks, Head of Commercial Real Estate, J.P. Morgan

Proptech market overview

If you think about proptech and the first names that come to mind are Zillow and Airbnb – you’re right. But that’s just the tip of the iceberg.

The proptech realm ranges from online platforms with property listings all the way to blockchain used for safe and transparent transactions. In between you’ll find property management software, data analytics tools, AR & VR, IoT, and many more.

With high numbers of market incumbents, there’s also a surge of startups entering the arena, poised to deliver innovative products and services that enhance efficiency, transparency, and overall user experience in property transactions and management.

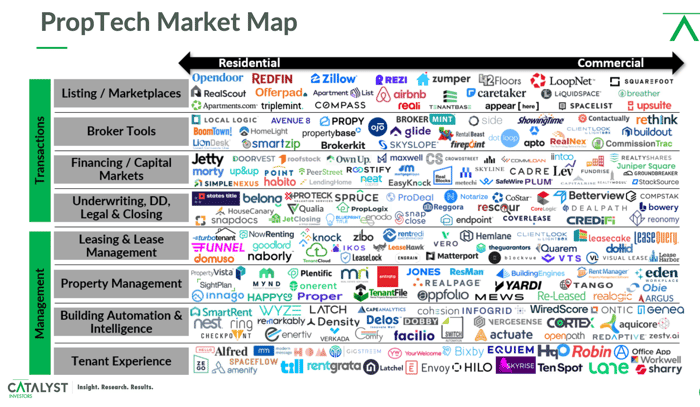

When examining the proptech landscape, encompassing solutions for both commercial and residential sectors, the entire market can be categorized into these two key segments: Transactions and Management.

Transactions:

- Listing / Marketplaces

- Broker Tools

- Financing / Capital Markets

- Underwriting, Due Diligence, Legal & Closing

Management:

- Leasing & Lease Management

- Property Management

- Building Automation & Intelligence

- Tenant Experience

Both supply and demand for proptech are high. The market is expected to grow significantly – from $19.6 billion in 2023 to $47.8 billion by 2033. That’s a compound annual growth rate (CAGR) of 9.3% in 10 years.

Top technologies that drive change

After initially resisting digitalization, the real estate market has come around to embrace the benefits of technology. Now, at the convergence of the third and fourth wave of proptech, more and more investments are expected to be poured into advanced technologies like:

- Virtual Reality (VR)

- Blockchain

- Artificial Intelligence (AI)

- GreenTech.

Top proptech trends for 2024

1. AI-powered property listing descriptions

Using AI to convert images into text makes it possible to generate property descriptions based on photos. There’s an increasing number of low-cost tools for that.

Apart from saving agents' time, it can also benefit the overall sales process. Data can be used to optimize images, perform A/B tests, and ultimately boost conversion rates across various channels.

Here’s a deep dive into how AI can help with image conversion rate optimization.

2. Data-powered market analysis

AI-powered platforms make it possible to analyze real estate projects faster than ever before. Data from multiple sources can be transformed into complex market analysis allowing for truly data-driven decisions, removing bias, making efficient choices and reducing costs.

For one of our US-based clients we built an ML-driven app that provides real estate developers with information – e.g. parcel data and predicted value across various investment scenarios – that helps them decide whether they want to move forward with an investment or not.

In the coming years we’ll surely witness more companies and individual investors leveraging AI for better real estate decision-making.

3. AI-chatbots & assistants

Did you know that 78% of leads stay with the realtor who responds first?

If you’re still not using chatbots, you’re missing out on an opportunity.

At Netguru we created a chatbot for a global leader in real estate franchise that offered agents instant access to all crucial data – e.g. contacts, referrals and market snapshots – with the most intuitive speed-to-text interface.

AI assistance doesn't stop with communication. With robo-advisors you can automate investment strategies, delivering personalized and efficient portfolio management with minimal human involvement, thus making it accessible to lower-capital consumers.

4. AI-driven marketing

AI brings automation to your real estate marketing efforts, increasing efficiency by 88% and simplifying the search for quality tenants.

Ads for new listings can now be instantly auto-generated, customized, and shared with precisely the right audience. As the audience reaches your website, AI chatbots take over, making lead capture much faster and easier. AI-backed CRMs analyze the probability of lead conversion. In short, AI reshapes the real estate marketing landscape.

Mountain View, an Egypt-based private property developer, increased sales by 5% using marketing automation with Oracle Eloqua.

“Oracle Eloqua offers us numerous features to run effective marketing campaigns. We can launch more targeted campaigns that help us improve our lead management process and boost sales.”

Tamer Hamed, Chief Information Officer at Mountain View

5. Energy optimization

With 40% of annual global CO2 emissions being driven by real estate, proptech is also used for decarbonization and energy optimization. These efforts translate into cost savings and increased profits.

One example being Cushman & Wakefield that decided to build software to help decarbonize their existing buildings. It assesses current carbon emissions and energy efficiency at each property and advises clients on how to reduce the environmental footprints of their real estate portfolios.

“Not only is decarbonizing existing real estate essential to addressing climate impact, but it also offers an environmentally responsible way to reduce the cost of owning and managing commercial property.”

John Forrester, CEO at Cushman & Wakefield

6. AR/VR-driven touring and staging

Virtual tours and 3D renderings offer prospective occupants a comprehensive understanding of a property's layout, condition, and amenities – all from the comfort of their own homes.

In today’s world technology can be used to showcase properties in various stages of construction, enabling real estate professionals to line up clients even before the properties are officially open.

In 2024, we’ll see an increase in the use of AR/VR in not only touring but also staging properties. With AR/VR, agents can show various furniture setups, making the buyer experience more immersive, thus increasing the chances of an actual sale.

7. Blockchain

Blockchain is emerging in the proptech landscape as a solution to complicated and costly real estate transactions. It allows to create digital agreements, store transaction details, and automatically execute based on predetermined conditions between buyers and sellers. This eliminates the need for third-party intermediaries and physical paper trails, enhancing both transparency and security in real estate transactions.

Additionally, tokens allow for partial investments, making the real estate market more accessible to the general public.

“Buying, selling and investing in real estate via NFT is only a matter of time. It’s lightning fast, cheap and far less prone to fraud. Whether you're a small-time hopeful or a giant investor, your investment pool just got bigger, faster, fairer and far more exciting.”

Johan Hajji, Cofounder at UpperKey

Top trending proptech companies in the US

1. Airbnb → $ 6.4 billion in funding

Airbnb is an online marketplace for long- and short-term homestays. It acts as a broker and charges a commission from each booking. Since its launch, the platform has grown to over 4 million hosts who have welcomed over 1.5 billion guest arrivals in almost every country across the globe.

2. EquipmentShare → $ 2.9 billion in funding

Whether you need to rent the right tool for a construction site, buy the latest machine, or streamline your operations with smart technology, you can get it all in one place. EquipmentShare is on a mission to enable the construction industry with tools that unlock substantial increases to productivity.

3. View → $ 2.6 billion in funding

View produces smart windows that use AI to automatically adjust in response to the sun, increasing access to natural light, while minimizing heat, energy consumption, and greenhouse gas emissions. Every installation also includes a smart building upgradeable platform that enables new capabilities and performance improvements over the lifetime of the building.

4. Opendoor → $ 1.9 billion in funding

Opendoor simplifies the process of buying and selling homes. It helps sellers to receive an offer without showing their home and buyers to browse for homes on sale and instantly unlock them using the app. Opendoor operates in 50+ markets.

5. Compass → $ 1.5 billion in funding

Compass is an end-to-end online platform supporting the entire buying and selling real estate workflow. With over 28,000 agents serving 72 markets in the US, Compass is now the country's largest independent real estate brokerage.

6. Pacaso → $ 1.5 billion in funding

Pacaso modernizes the generations-old practice of co-owning a second home by creating a marketplace that makes buying and selling easy and adding professional management and technology to make scheduling dates and owning the home seamless and simple.

7. Hippo → $ 1.3 billion in funding

Hippo offers homeowners insurance, making it more affordable for consumers and more profitable for insurers by handling most processes online. Hippo also offers a variety of valuable resources, including tips on how to take care of a house in a way that prevents minor problems from becoming expensive headaches.

You can read more about Hippo and other interesting proptech companies here.

In proptech there’s no time to waste

The future of real estate is being shaped by the dynamic evolution of proptech. After years of tech-hibernation the real estate industry has finally woken up and is hungry for change.

Proptech companies themselves understand that the key to efficient innovation is accelerated speed-to-value. Best way to achieve it is through minimum viable products that allow for swift validation of new concepts.

If you want to build your MVP, you’re in the right place. The Netguru team will help you navigate these waters and offer tailor-made MVP services according to your business needs and requirements.