Accelerating KYC for a Leading Payment and Compliance Infrastructure Provider

We partnered with a financial technology company to help develop a KYC tool for their payment and compliance infrastructure. We ensured KYC user verification and integration with KYC providers, and enabled on demand manual approvals.

Dock Financial is a financial technology company specializing in payment and compliance infrastructure, targeting banks, financial institutions, and established fintechs, but also companies and organizations in other industries such as insurance, mobility, or travel.

Through the Dock Financial infrastructure, clients can efficiently manage payment and compliance processes in a modular fashion to optimize internal workflows or create their own offerings towards their users, thereby generating added value with additional revenue potential.

Dock Financial provides its technical services through APIs or, for specific use cases, via its Plug & Play solutions. Furthermore, Dock Financial has the capability to offer regulatory services within Europe through its own licensed setup, if necessary.

The challenge

We partnered with Dock Financial to help them develop a Know Your Customer (KYC) tool and its architecture for their payment and compliance infrastructure. Our job was to ensure KYC user verification and integration with KYC providers, as well as enabling on demand manual approvals.

The project

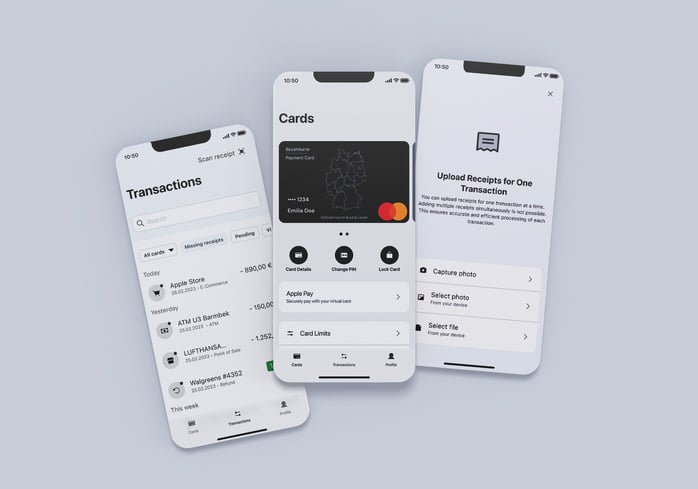

The project had two main phases: an MVP phase and the support in the development of the actual compliance infrastructure of Dock Financial. The development of the KYC tool involved providing an API that would enable the customers to conduct a one-time customer verification and reuse the same KYC profile for subsequent partners.

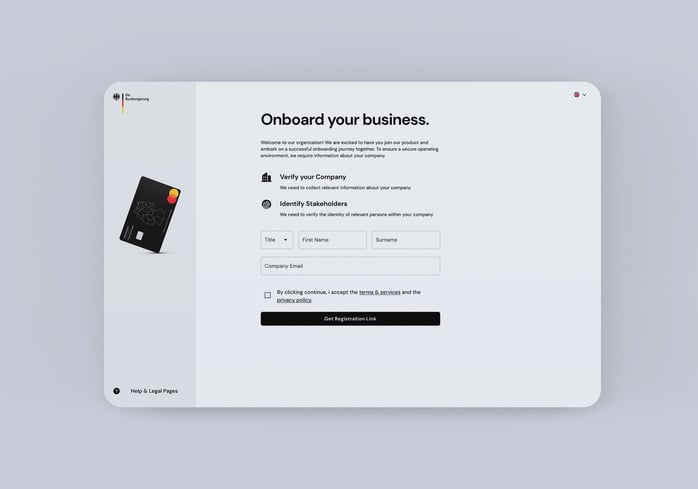

After the initial MVP phase, we supported Dock Financial to add more modules and functionalities to their compliance infrastructure. Next to the KYC tools, we helped build a product that could support Know Your Business( KYB) functionalities to comply with regulatory requirements.

Project challenges included overcoming obstacles around data confidentiality and the client’s overall information security.

The journey

Phase 1

- MVP development – initial version of the API with basic functionalities

- Integration with external services: verification of natural persons and customer communications

- Creation of a mono repository containing four microservices, five different authentication methods, and project documentation with diagrams

Phase 2 [in progress]

- Addition of company verification capabilities as well as maintaining and expanding natural and legal person verification capabilities

- Refactoring of the initial KYC solution, creating new repositories, database division, and updates to endpoints and documentation

- Integration with different data service providers for business verification

- Implementation of risk assessment functionalities

Throughout the project, the client was also provided with ongoing support in DevOps, frontend, and design areas on an on demand basis.

The results

- The client enjoys operational improvements, increased efficiency, and enhanced business performance.

- Collaboration with Netguru brought process optimization, technology upgrades, and increased customer engagement.

- The tools’ architecture enables easy integration and removal of future clients, taking into account security and privacy considerations.