Agile Delivery for a Digital Wealth Management Solution

In a sector where personal trust means everything, and security and regulatory compliance are crucial factors, one cannot simply remove the human element from the equation.

Over recent years, Fintech has pervaded much of the financial services industry. However, financial advice companies have generally lagged behind; stuck between the two extremes of fully-automated robo-advice and human advisers inhibited by a lack of proper digital tools.

Digital Wealth Solutions addresses the issue by providing a unique product that is bringing financial advisers up to speed for the 21st century. They are part of a pioneering new Fintech area… AdviceTech.

Let us introduce you to the “digital front office for financial advisors.”

Digital Wealth Solutions - technological innovator on the wealth management scene

Prior to establishing DWS in 2017, the co-founders considered how best to innovate in the financial advice sector. Based on their deep sector experience and technological understanding, the co-founders understood that financial advice firms were largely stuck in the 20th century and that there was a systemic need for sector innovation.

Advice firms’ propositions and operations were largely based on face-to-face consultations and physical paperwork, and involved minimal use of client-facing technology. These factors inhibited advice firms’ growth, efficiency and, most importantly, the provision of top-class client service. Digital Wealth Solutions set out to address this.

However, instead of trying to replace financial advisers entirely, DWS’s starting premise was to assume that traditional financial advice is fit for purpose, but that it could be improved through well-designed technology.

As such, DWS’s co-founders envisaged providing financial advice firms with a tech-enabled proposition that would sit alongside and complement advisers’ traditional face-to-face, relationship-oriented client service.

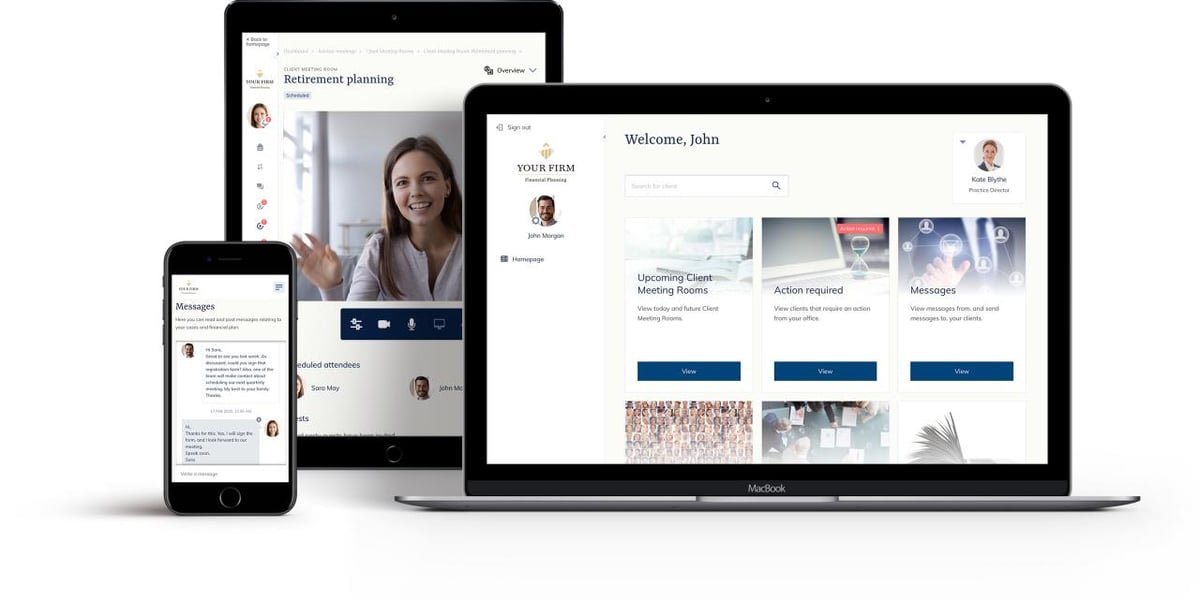

They envisioned a digital platform that would give financial advice firms a ‘digital front office’ to use with their clients. The platform was to be customizable, interactive, and allow various interactions between the financial advisor and the client.

It was to include such elements as private video meetings, recommendation sharing, meeting organisation, digital document signing, document vaults, and chat - all in a secure, compliant, and user-friendly environment.

About the project

DWS’s vision for their innovative software product was clear early on. However, the company had to choose between building an in-house development team or partnering with an external agency to realize the project. There was no similar platform on the market (and there still isn’t), so the company wanted to move quickly to create an enterprise-quality platform.

After careful consideration, DWS appointed Netguru as their delivery partner and primary technology adviser. This appointment gave DWS access to ready-to-go skills and expertise.

The challenges of bringing one of the first AdviceTech products to market

The platform needed to support the entirety of the financial advice process – from client acquisition, through the provision of regulated advice to the supporting of clients on an ongoing basis.

From a client’s perspective, the DWS platform was to offer a personal, private, secure space in which to manage their financial affairs and meet with their adviser. For advisers, the platform needed to help them to acquire clients, advise clients, and manage costs - all in a manner that complements their traditional face-to-face service.

The complexity of the project was not just limited to functional features, however. Numerous critical non-functional considerations needed to be addressed. For example, the platform needed to performantly accommodate many thousands of different advice firms and users, and ensure that their data was securely segregated, accessed and managed.

Also, since wealth management firms handle highly-sensitive information, our team also had to prioritize security at every stage of design and development. Of course, this was not just an architectural challenge, but a user experience design challenge also. The user experience had to complement and support the trusted relationship between a client and their financial adviser.

How Netguru tackled the challenges

Working closely over the course of the last 3 years, DWS and Netguru together delivered an enterprise-quality, functional, secure, and reliable platform.

The project team combined DWS’s expertise in financial advice and business with Netguru’s technological know-how. Netguru brought many years of experience in agile processes; that enabled quick delivery with constant improvements along the way. The main stages of our work were:

- Solution shaping

We explored potential solutions and made sure they were technologically robust, well-designed, and appropriate for the advice process. We developed prototypes during this stage.

- Development

Here Netguru’s development team stepped in and followed an agile delivery approach to build the desired features.

- Testing

During the development process we performed regular technical and end-user testing and made periodic deployments. Performance tests were also conducted.

- Final deployment

We delivered the platform to DWS ready to be offered to enterprises and used by advisers and clients.

The platform is now fully functional. However, we continue to work with DWS to improve its functional and non-functional aspects.

Outlook

DWS are now rolling out their service to financial advice firms. In the future, DWS may expand beyond financial services; the core DWS proposition is just as relevant to other professional advisers - e.g. solicitors, consultants, accountants.

As AdviceTech builds momentum in the financial advice sector, DWS now has an advantage of being at the forefront of the sector’s digital revolution. Working together with Netguru, DWS aims to reinvent how professional advisers collaborate with their clients.