Why You Need Custom Voicebot to Streamline Claims in Insurance

Processing damage claims in the insurance industry has traditionally relied on manual workflows. Agents handle basic tasks like gathering names, ages, and claim details through straightforward, question-and-answer interactions. These repetitive processes are ideal for automation, yet many insurers depend on human operators—driving up costs, especially in high-volume call centers.

Since operational efficiency accounts for 60% of an insurer’s performance (and 40% of an insurer's portfolio choices), improving claims handling is a key driver of success. While automation can ease this burden, not all solutions are equally effective.

Off-the-shelf voicebot solutions can provide some efficiency, but they often fall short for insurance-specific needs. Generic tools struggle with complex workflows, lack seamless integration with existing systems, and fail to provide the flexibility needed for a smooth customer experience.

Custom AI voicebots solve these issues by automating repetitive tasks with speed and precision, tailored specifically to the demands of claims processing.

This article explores how custom voicebots can streamline claims registration, cut costs, and boost customer satisfaction—proving why tailored solutions outperform generic alternatives in the insurance industry.

The Challenges of Manual Damage Registration and Claims Processing

Manual claims processing comes with several well-known challenges that hinder efficiency and customer satisfaction:

- Overloaded Call Centers: High call volumes overwhelm staff, resulting in long wait times.

- Error-Prone Processes: Human errors during data collection or registration lead to delays.

- High Operational Costs: The need for large teams and the extended time required for each call increases expenses.

- Customer Dissatisfaction: Frustrations from long waits, errors, and inefficiencies contribute to a negative experience, eroding customer trust.

A report by Accenture found that poor claims experiences could put up to $170 billion in insurance premiums at risk over the next five years. One-third of policyholders were dissatisfied with their claims process, mainly due to slow settlements and issues with claim closure. As a result, 30% of unhappy customers had already switched insurers, while nearly half (47%) were considering it—highlighting how inefficiencies in claims handling directly drive customer churn.

Switching to AI-powered voicebots presents a compelling opportunity to address these challenges. Automating routine inquiries can save businesses up to 60% in customer service costs while improving efficiency. Research shows that just a 1% improvement in the loss ratio for a $1 billion insurer could translate to more than $7 million in savings, demonstrating the financial impact of AI-driven claims automation.

Why Box Solutions Are Not Sufficient for Insurance Industry Needs

While automation can address inefficiencies in manual claims processing, off-the-shelf voicebot solutions often fall short in the insurance industry. These generic tools may seem convenient, but they come with significant drawbacks:

- Limited Customization: Generic solutions lack the flexibility to adapt to specific workflows, resulting in impersonal interactions and frustrated clients.

- Complex Scenarios: Standard tools struggle with nuanced requirements such as multilingual support, detailed damage claims processing, and strict regulatory compliance—key needs in insurance operations.

- Integration Challenges: Many off-the-shelf products face compatibility issues with existing CRM or ticketing systems, leading to inefficiencies rather than solving them.

- Data Privacy Concerns: With increasingly strict regulations (GDPR in the EU, CCPA in California, etc.), insurers must ensure that sensitive customer data is fully protected.

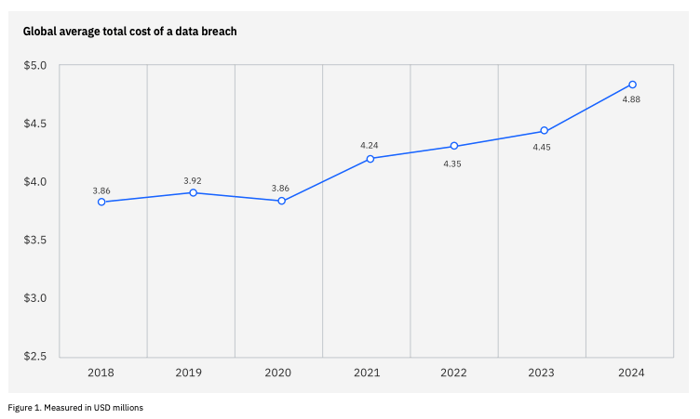

A 2024 IBM reportfound that the global average cost of a data breach is USD 4.88 million, representing a 10% increase from the previous year, highlighting the growing need of robust security measures.

Additionally, data access remains a major concern when using third-party voicebots. Without proper safeguards, insurers risk data leaks, reputational damage, and hefty fines.

To truly streamline claims processing, insurers need tailored solutions—ones that provide seamless integration, regulatory compliance, and a personalized customer experience.

Voicebots vs. Manual Processes: A Cost-Effective Solution

Many people have had frustrating experiences with AI voice bots. Older systems followed rigid scripts, often misunderstanding customers and giving robotic, unhelpful responses. Today’s AI is different. Large language models (LLMs) bring contextual awareness, allowing bots to understand intent, detect emotions, and respond intelligently. Instead of just following a script, they adapt to conversations—making interactions feel smoother and more natural.

To assess the real impact of AI voicebots in claims processing, we conducted a cost simulation comparing human-led claim registration (averaging 4.5 minutes per claim) with an AI-powered voicebot equivalent. The results show that custom voicebots provide a clear advantage over manual claims handling by delivering both measurable cost savings and operational improvements. Here’s how they compare:

- Cost Savings – Manual claims handling requires staffing and prolonged call durations (averaging 4.5 minutes per call), costing around $1.50 per interaction. With tools like Azure OpenAI and Twilio, a voicebot can handle the same interaction at just $0.1915 per call, reducing costs significantly at scale.

- Scalability – Unlike human agents, voicebots operate 24/7, handling multiple calls simultaneously without additional staffing or overtime costs.

- Efficiency in Damage Registration – Automating repetitive data collection ensures faster claim registration and eliminates errors common in manual processes.

- Total Savings – A call center managing 100–150 calls daily could save over $3,900 per month by switching to a voicebot.

| Criteria | Manual Process | AI Voicebot |

| Cost per call | $1.50 | $0.1915 |

| Scalability | Limited (requires staffing) | Unlimited (24/7 availability |

| Monthly savings (100-150 calls/day) | N/A | $3,900+ |

Netguru’s Case Study: Proof of Concept for a Custom Voicebot

While our focus here is on claims processing in insurance, we have successfully developed a similar Proof of Concept (PoC) voicebot for another industry—retail. The core principles of automation, integration, and efficiency remain the same, demonstrating how AI-powered voicebots can transform service workflows across sectors.

To streamline service issue reporting and claims processing for a grocery franchise, Netguru developed a PoC voicebot that enabled franchisees to submit service requests via voice instead of manual entry. The pilot phase was planned for 50 stores, with a broader rollout contingent on its success.

What Was Done

The voicebot was designed and built using Azure OpenAI, Twilio, and Azure Speech Services. Its development focused on addressing the specific needs of insurance workflows:

- Data Extraction: Enabled seamless collection and categorization of claim-related data.

- Multilingual Support: Ensured accessibility for diverse customer bases by supporting multiple languages.

- Interruption Handling: Incorporated natural flow adjustments to accommodate customer interruptions during interactions.

- CRM Integration: Provided smooth synchronization with existing customer relationship management systems to enhance operational efficiency.

This PoC was developed and delivered within 6–10 weeks by a dedicated team of machine learning engineers and DevOps specialists, ensuring both speed and scalability.

While the industry focus was different, the methodology and approach to building the voicebot mirror what’s needed in insurance claims automation.

Key Features of a Custom AI Voicebot

Custom AI voicebots are designed to meet the unique demands of the insurance industry, offering tailored solutions that enhance efficiency and integration. While some of these features exist in off-the-shelf solutions, custom voicebots ensure deeper adaptability, seamless integration, and more precise automation for insurance workflows.

Key features include:

- Integration with Insurance Systems – Connects with existing CRM platforms and ticketing systems, ensuring smooth data flow and automated escalations.

- Multilingual Support – Handles interactions in multiple languages to serve diverse customer demographics, with custom models fine-tuned for industry-specific terminology.

- Advanced Capabilities:

- Natural Language Processing (NLP) enables conversational interactions that feel more natural and context-aware.

- Interruption Detection and Escalation allows the bot to adapt dynamically, ensuring no critical information is missed—a feature that custom bots refine for complex claims scenarios.

- Data Extraction and Input automates repetitive tasks like collecting claim details, structured specifically for insurer workflows to reduce errors and accelerate processing.

- Scalability for Future Needs – Custom voicebots are built to grow with the business, enabling expansion beyond claims handling to support broader workflows and increased call volumes.

- Automated Ticket Generation – AI-powered automation fills out and submits support tickets with required details, ensuring seamless task handoff to human teams.

- Deep Call Insights for Business Optimization – AI-driven analytics help insurers identify recurring issues and optimize processes.

By leveraging these capabilities, custom AI voicebots go beyond generic automation, providing a solution built specifically for insurers’ claims processing and customer interaction needs.

Frameworks for Building Voicebots and How They Work

Developing an AI-poweredvoicebot no longer requires building speech recognition models from scratch. Pre-built AI frameworks provide ready-to-use APIs and SDKs, allowing businesses to integrate advanced speech-to-text and voice processing into their workflows with minimal setup. These frameworks convert spoken language into structured text, process the request using AI, and generate natural-sounding responses, creating a seamless conversational experience.

At Netguru, we often use OpenAI Whisper and Microsoft Azure Speech Services to develop custom voicebot solutions for our clients. These frameworks provide:

- Speech-to-Text (STT) Capabilities: Converting customer speech into accurate, structured text for further processing.

- Natural Language Processing (NLP): Understanding intent, extracting key information, and handling complex queries.

- Text-to-Speech (TTS) Processing: Generating human-like responses in multiple languages and tones for a more engaging experience.

- Real-Time Streaming & Low-Latency Responses: Allowing the bot to process and respond in parallel, ensuring a more natural interaction.

Microsoft Azure Speech Services offers additional advantages, including seamless integration with CRMs, ticketing systems, and analytics platforms, making it ideal for enterprise use cases like insurance claims processing. Meanwhile, OpenAI Whisper is recognized for its highly accurate transcription capabilities, even in noisy environments, ensuring that voicebots can understand customer input with precision.

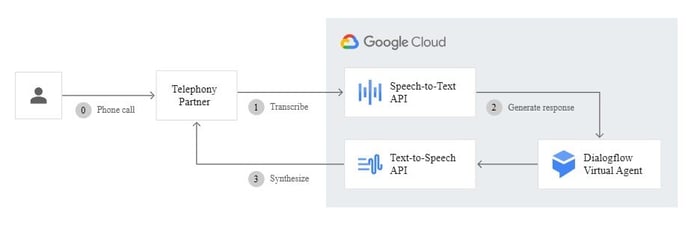

Another strong framework is Google’s Dialogflow, which powers AI-driven voicebots for contact centers. Unlike traditional systems that rely on static, pre-recorded audio, Dialogflow dynamically generates speech responses, making conversations more fluid and engaging. Integrated with Google Cloud’s Text-to-Speech API, it enables high-quality, synthesized voices that create a more personalized experience for callers.

Source: https://cloud.google.com/text-to-speech?hl=pl

How a Voicebot Call Processing Flow Works

When a customer calls, the telephony provider (e.g., Twilio) handles the call routing and streams the audio via API to a speech-to-text (STT) service such as OpenAI Whisper or Azure Speech Services. The STT engine transcribes the spoken input into text and forwards it to a large language model (LLM) like GPT-4, which analyzes the query, detects intent, and generates a response based on the context.

The generated text is then sent to a text-to-speech (TTS) engine (e.g., ElevenLabs or Google Cloud TTS), which converts the response into a natural-sounding voice. Finally, the telephony provider transmits the voice output back to the caller, completing the conversation loop.

- Caller speaks → Voice is captured by Twilio and streamed via API.

- Speech is transcribed → Sent to STT (e.g., OpenAI Whisper, Azure Speech-to-Text).

- Text is processed → Passed to LLM (e.g., GPT-4) to understand intent and generate a response.

- Response is converted to speech → Sent to TTS (e.g., ElevenLabs, Google Cloud TTS).

- Voice response is played → Sent back through Twilio and delivered to the caller.

One of the key challenges in voicebot interactions is response latency—unlike a human agent who can process speech in real time, AI systems need a brief moment to analyze, interpret, and generate a response. This delay can be frustrating for users. However, modern token-by-token processing techniques help bridge this gap. Instead of waiting for the entire query to be processed before responding, the system generates output in parallel as it processes incoming speech. This allows the voicebot to start delivering an answer while still analyzing the full context, creating a more natural and fluid conversation.

Implementation Roadmap for a Voicebot Solution

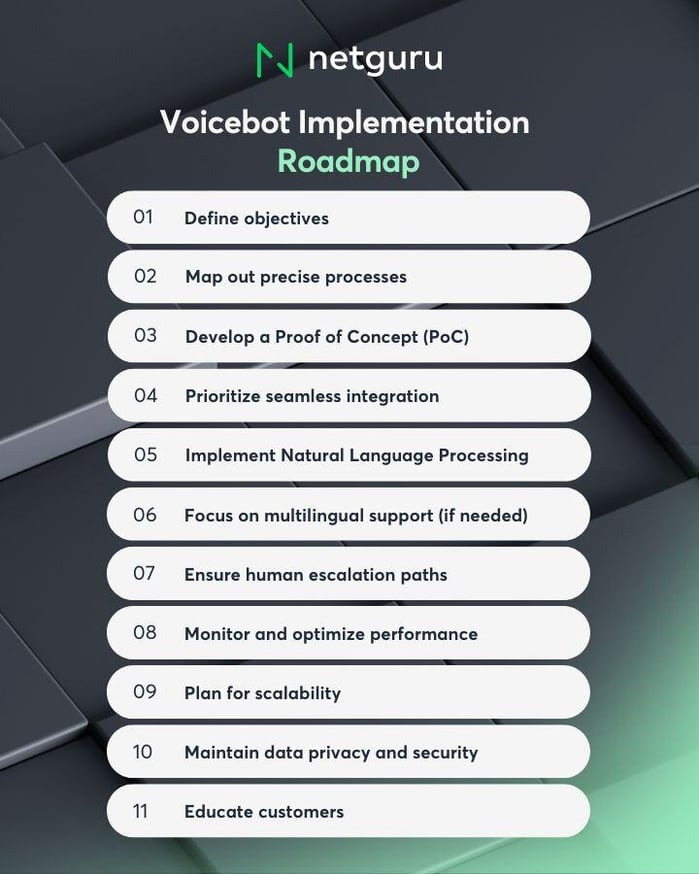

To successfully implement a voicebot for insurance services, companies need to follow a strategic roadmap. Here are the key steps to ensure the voicebot delivers value for both the business and its customers:

- Define Objectives

Determine the voicebot’s core function—automating damage claims, answering FAQs, or handling policy inquiries. Clear objectives align features with customer needs and business goals. - Map Out Precise Processes

Before development begins, create a detailed process map outlining every step the voicebot will handle. This ensures smooth automation, reduces friction points, and prevents gaps in customer interactions. - Develop a Proof of Concept (PoC)

Start with a single process, such as damage claim registration. Test features like data extraction, multilingual support, and system integration using tools like Azure OpenAI, Twilio, or Azure Speech Services. - Prioritize Seamless Integration

Ensure compatibility with CRMs, ticketing systems, and call-routing platforms. Smooth integration eliminates inefficiencies and supports streamlined workflows. - Implement Natural Language Processing (NLP)

Equip the voicebot with NLP to manage complex, human-like conversations. Continuously refine the model for improved understanding and accuracy. - Focus on Multilingual Support (If needed)

Enable communication in multiple languages to serve diverse customers effectively and inclusively. - Ensure Human Escalation Paths

Design the voicebot to identify issues requiring human intervention. Set up clear escalation protocols that retain customer context for a seamless handoff. - Monitor and Optimize Performance

Track KPIs such as handling time, accuracy, and customer satisfaction. Use analytics to identify areas for improvement. - Plan for Scalability

Build the system to handle higher call volumes and expand capabilities beyond the initial use case, ensuring long-term adaptability. - Maintain Data Privacy and Security

Implement encryption and comply with regulations like GDPR or CCPA to protect sensitive data and foster trust. - Educate Customers

Provide simple, clear instructions on how to use the voicebot. Help customers navigate tasks like filing claims or renewing policies, enhancing their overall experience.

Conclusion: Automate Today for a Better Tomorrow and Customer Satisfaction

Insurance companies face increasing pressure to streamline claims processing while maintaining high service quality. Manual workflows burden call centers with high costs, long wait times, and human errors, making automation a clear opportunity.

While AI voicebots offer a cost-effective alternative, off-the-shelf solutions fall short of the insurance industry's complex requirements. They struggle with system integration, multilingual support, regulatory compliance, and industry-specific workflows.

Custom voicebot solutions provide insurers with a powerful tool to streamline processes, reduce costs, and improve customer experience. As AI continues to evolve, its role in customer service will only expand. Insurers who embrace AI technology today will gain a competitive edge, enhancing efficiency and ensuring long-term adaptability.

Supervised by Patryk Szczygło, R&D Lead at Netguru