Boosting Mobile Banking in Africa With Staff Augmentation

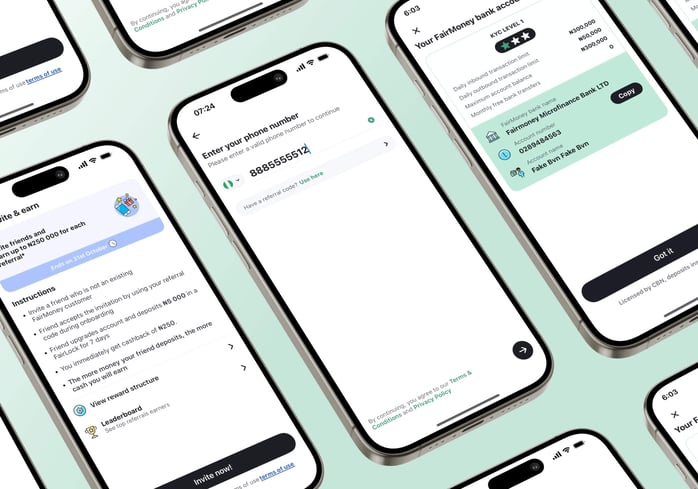

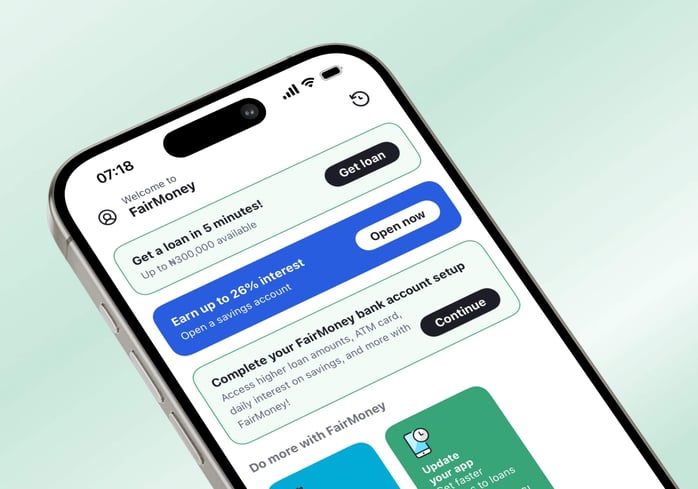

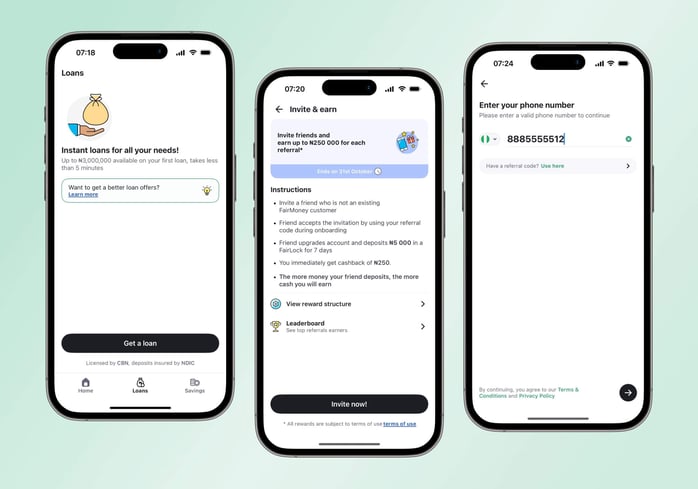

FairMoney, an Africa focused fintech headquartered in France, owns the number one most downloaded fintech app in Nigeria. The company came together with Netguru to scale their mobile engineering team in line with rapid growth. The extended team worked on every part of the client’s app, such as the lending, banking, and KYC components.

Client

FairMoney is an Africa focused fintech company headquartered in France, with primary operations in Nigeria. Established in 2017, FairMoney offers quick and accessible financial services through a mobile app, including instant loans, savings accounts, and more.

As Africa’s leading neobank, it has been ranked as one of the fastest-growing companies on the continent according to the Financial Times.

With over $40 million in funding, FairMoney focuses on bridging financial gaps by providing accessible and convenient solutions to underserved individuals and small businesses.

Challenge

FairMoney's explosive user growth—1 million in just six months—intensified the pressure to deliver high-quality services efficiently.

However, the company faced several challenges:

- A rapidly expanding user base necessitated the swift delivery of a safe, stable mobile banking application

- Time-to-market pressures were exacerbated by fast followers in the market, demanding accelerated development cycles

- The need for improved internal communication, onboarding processes, and testing procedures became critical

To solve this, the client had to scale up the engineering team quickly, so they turned to us for staff augmentation.

Goals

The project focused on enhancing FairMoney's banking products, particularly in the African market, with a primary emphasis on Nigeria.

The main goals we focused on were:

- Delivering a stable mobile banking application quickly

- Accommodating the rapid growth in user demand

- Accelerating the application development process to maintain a competitive edge in the market

Journey

Our job was to ensure that all banking products adhered to legal requirements set by regulatory bodies. What’s more, we were asked to incorporate data collection processes required by the Compliance department into the user registration process.

However, the most valuable contribution circled around KYC processes.

We were tasked with:

- Implementing an identity verification system through external service providers for current FairMoney users

- Modifying the registration process for new users to include these verifications

- Preparing and integrating a feature that allows in-app identity verification, enabling users to increase their transaction limits

Integrating user registration with AML software

Results

Our collaboration with FairMoney resulted in improved efficiency. The extended team worked on every part of the client’s app, such as the lending, banking, and KYC components, making it easier for FairMoney to expand into new African regions.

What went well:

- Rapidly scaled engineering team in line with client needs

- Accelerated time to market, allowing FairMoney to stay ahead of fast followers in the fintech space

- Application adapted to specific requirements of the markets

- Enhanced system functionality and optimized business processes, leading to better user experiences

- NPS score of 9