Multi-Layered KYC Solution For the Number One Fintech App in Nigeria

Nigeria’s leading fintech app, FairMoney, needed a scalable and compliant KYC solution to support rapid user growth and regulatory demands. Netguru enhanced their mobile and backend engineering teams, integrating a multi-layered KYC system with secure identity verification, AML compliance, and onboarding across multiple countries.

Netguru enhanced mobile and backend engineering, integrating identity verification, AML compliance, and seamless onboarding. QA support ensured accuracy, enabling secure, scalable financial services across Africa.

Client

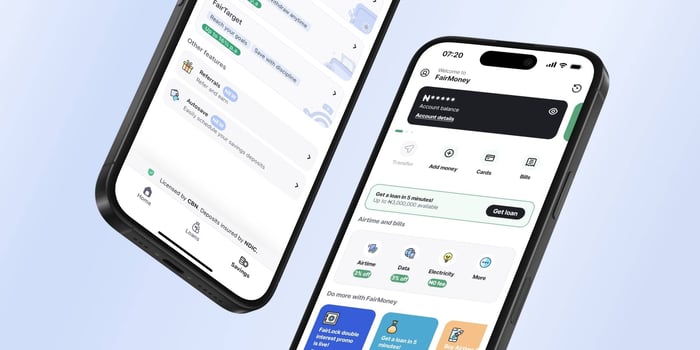

FairMoney, founded in 2017, provides accessible financial services in Nigeria and beyond through a mobile app that includes instant loans, savings accounts, and more. With over $40 million in funding, FairMoney’s mission is to bridge the financial inclusion gap for underserved individuals and small businesses in Africa.

Rapidly expanding across the continent, FairMoney continues to adapt its operations to meet both market demand and evolving regulatory standards.

Challenge

As FairMoney expanded to over a million users within six months, they faced increasing complexity in delivering compliant, high-quality services across multiple countries.

The main challenges they faced included:

- Inconsistent quality among KYC providers in the African market, impacting user data integrity.

- Verification issues from data inconsistencies, creating challenges in user onboarding and compliance.

- Diverse regulatory requirements by country, requiring KYC solutions that could adapt flexibly.

- Ongoing changes in compliance standards, necessitating a robust and agile KYC solution.

To tackle these challenges, FairMoney collaborated with Netguru for a multi-layered KYC integration capable of meeting evolving needs while ensuring compliance and security.

Goals

The primary objectives of this project were:

- Developing a flexible KYC solution that could reliably meet legal requirements across multiple regions.

- Implementing secure, high-quality identity verification to boost compliance and foster user trust.

- Enabling quick market entry into new countries by integrating with localized KYC providers.

- Enhancing user experience with a fast, seamless onboarding process to drive user conversion.

Project Journey

Netguru’s team provided strategic staff augmentation and technical expertise to support Fairmoney technical implementation strategy.

Key deliverables included:

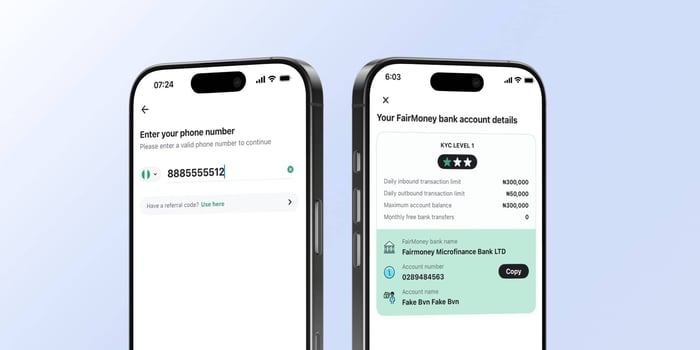

- Ensuring user verification through secure facial recognition and government ID verification.

- Verifying two mandatory documents for Nigerian users—Bank Verification Number (BVN) and National Identification Number (NIN)—along with user ownership of the phone number and residential address verification.

- Multi-country KYC provider integration by onboarding two providers for Uganda and one for Zambia to facilitate secure onboarding for users in these markets.

- Integrating with Nigeria’s National Identity Management Commission (NIBSS) to meet compliance standards for user data consent.

Technology Stack

We supported the implementation of Kotlin Multi-Platform to enable simultaneous Android and iOS delivery, which minimized time to market. Additionally, we used Jetpack Compose to build a consistent and user-friendly UI across both platforms. We also implemented robust backend solutions that supported seamless integration of KYC providers and ensured secure, real-time data processing.

Results

The collaboration yielded impressive results that strengthened FairMoney's position in the African fintech market:

- The KYC process empowered FairMoney’s Nigerian users to access various financial services, including loans, savings accounts, and more.

- The flexible KYC framework enabled integration with new providers in under three months, supporting rapid expansion across different regions.

- Streamlined KYC processes ensured compliance with local regulations, providing an intuitive onboarding experience for users.

- Netguru’s collaboration with FairMoney earned an NPS score of 9.