Netguru’s Top Fintech Case Studies: Addressing Market Challenges with Innovative Solutions

As Pedro Rivas, General Director of Mercado Pago, put it, “There is a series of players that are achieving that users have confidence in them and begin to digitize their finances.” This underscores a fundamental reality: trust is the cornerstone of fintech success. Without it, even the most groundbreaking innovations risk failing to gain traction.

Netguru collaborates with fintech companies to craft tailored solutions that meet evolving market demands while building lasting user confidence. In this article, we’ll showcase some of Netguru’s standout fintech projects and demonstrate how we help businesses reach their goals.

Market Landscape and Challenges in Fintech

The Fintech Trends

The fintech industry is poised for significant expansion, with the global market projected to grow from $103.75 billion in 2024 to $141.18 billion by 2028 (Finextra). Total transaction value in the Digital Payments market alone is expected to reach $20.37 trillion in 2025 (Statista).

In 2025, AI improves customer experiences and makes processes more efficient. AI automation now handles tasks like compliance checks and loan processing, saving time and reducing errors. AI-powered chatbots can provide real-time, personalized support, making customer service faster. At the same time, institutions are working to comply with stricter regulations like the EU AI Act, which sets new standards for AI systems.

Blockchain and Decentralized Finance (DeFi) are also making waves, with predictions that 10% of the world's assets will be tokenized by 2027 (World Economic Forum). The increasing adoption of stablecoins for cross-border payments is a notable trend, offering faster transactions, reduced volatility, and improved liquidity.

Another key trend for the European Union market in 2025 is the enforcement of the EU Accessibility Act, requiring financial services and digital banking platforms to meet strict accessibility standards for people with disabilities.

In addition, ESG (Environmental, Social, Governance) reporting is becoming a focus area.With expanding regulations such as the EU’s Corporate Sustainability Reporting Directive (CSRD), businesses are under pressure to deliver consistent, reliable sustainability data.

Challenges in Fintech

Despite its rapid growth, fintech faces a number of critical challenges. Cybersecurity threats continue to rise as attackers leverage AI to craft sophisticated attacks, while companies deploy AI to detect anomalies, predict breaches, and safeguard customer data (Fintech Newsroom).

Blockchain adoption faces challenges, including scalability and infrastructure needs. Collaboration with banks is essential, as they provide financial infrastructure, consumer trust, and regulatory guidance. Banks also enable smooth fiat-to-crypto exchange, bridging traditional finance and the crypto ecosystem (ClearBank).

Lastly, ESG transparency presents challenges tied to inconsistent data standards across jurisdictions (EY). The emergence of harmonization platforms for sustainability reporting is expected to address this bottleneck, allowing firms to meet growing regulatory requirements.

Selected Netguru Fintech Case Studies

1. Spendesk: Enabling In-App SEPA Payments for French Fintech Unicorn

-2.jpg?width=700&height=367&name=Bespoke_Hero_Background%20(1)-2.jpg)

Spendesk, a French fintech unicorn specializing in spend management, partnered with Netguru to develop an internal banking system for SEPA payment processing. The goal was to enhance autonomy, streamline operations, and reduce dependency on external providers.

Objectives

-

Integrating SEPA payment functionality into a web app.

-

Ensuring compliance with SEPA regulations through BPCE PS certification.

-

Handling complex internal payment logic and workflows.

-

Implementing rigorous testing to ensure stability and quality.

Outcomes

Netguru provided a team of experts who collaborated with Spendesk to design, develop, and test the banking system. This included creating a unified testing strategy, managing certification requirements, and ensuring seamless integration of SEPA Instant payments.

Spendesk successfully completed BPCE PS certification, deployed its updated system to production, and processed initial test payments. The platform was further enhanced with SEPA Instant payments and integrated anti-money laundering monitoring.

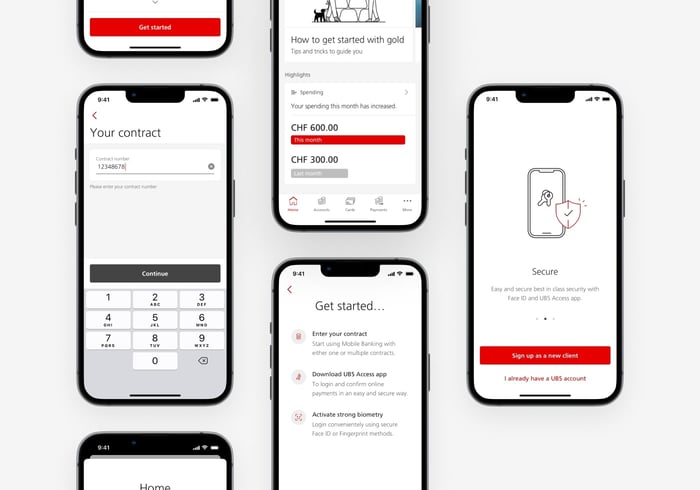

2. UBS: Redesigning Mobile Banking App

UBS, Switzerland’s largest banking institution and the world’s largest private bank, partnered with Netguru to elevate its mobile banking app. The goal was to deliver a best-in-class, user-friendly experience while transitioning to modern frameworks and enhancing the app's performance and usability.

Objectives

-

Ensuring a seamless mobile experience with consistent payment flows.

-

Shortening the login process and improving in-app navigation.

-

Transitioning from a hybrid Cordova framework to native iOS and Android development.

-

Building and evolving a scalable mobile design system.

Outcomes

-

Redesigning the app’s login, navigation, and payment features with a mobile-first approach.

-

Contributing to a native mobile design system, including reusable components.

-

Conducting usability testing and market analysis to inform design decisions.

-

Supporting the migration to native technologies for improved app performance.

UBS introduced redesigned payment features, a simplified login process, and a user-friendly home screen with financial insights and tailored product suggestions. Improved loading speeds, better error handling, and a reusable components library ensured a seamless user experience and scalability for future updates.

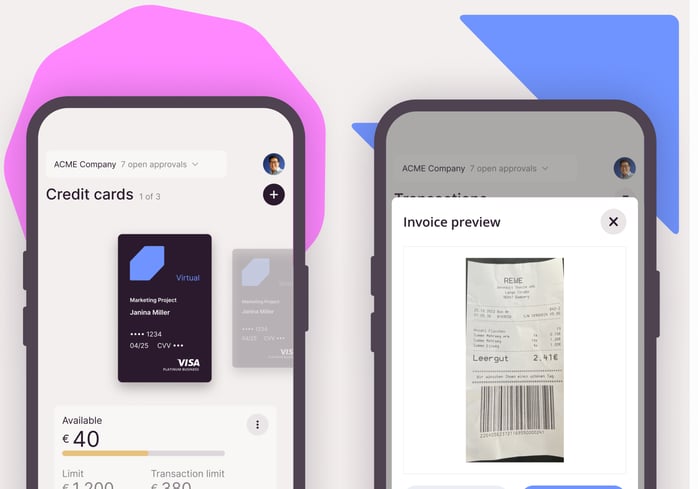

3. Candis: Developing a Mobile App MVP in 16 Weeks

Candis, a Berlin-based fintech startup specializing in AI-powered invoice management software, partnered with Netguru to build a mobile app MVP. The goal was to complement their web-based platform, enabling faster, more convenient invoice processing on the go.

Objectives

-

Deliver a mobile app MVP with a complete invoice processing flow and notification system.

-

Enable 2-factor authentication (2FA) in preparation for the Candis Wallet feature.

-

Ensure delivery within 16 weeks while adhering to the budget.

-

Provide expertise in mobile app development and take ownership of the process.

Outcomes

Netguru provided guidance on product roadmap and assembled a dedicated team, including React Native developers, a project manager, and a Quality Assurance expert, to deliver:

-

Delivered a fully functional mobile app MVP for both iOS and Android within 16 weeks.

-

Reduced average invoice approval duration from 3-4 days on the web to under 2 days on mobile.

-

Achieved 2000 iOS users and 400 Android users, with 1200 monthly approvals processed via the app.

-

Enabled 2FA, paving the way for future credit card processing functionality.

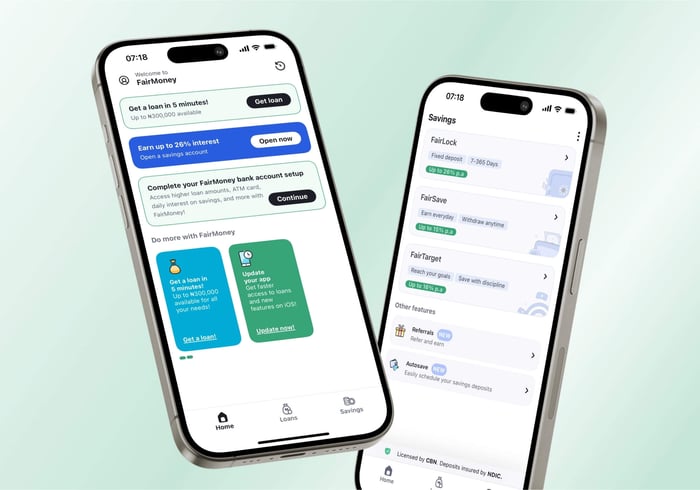

4. FairMoney: Boosting FairMoney's Mobile Banking in Africa With Staff Augmentation

FairMoney, an Africa-focused fintech headquartered in France, partnered with Netguru to scale their mobile engineering team in response to rapid growth. The collaboration aimed to deliver a stable and efficient mobile banking application to meet the demands of an expanding user base.

Objectives

-

Deliver a stable mobile banking application tailored to the African market.

-

Scale the engineering team to accommodate rapid user growth.

-

Accelerate application development to meet time-to-market pressures.

-

Ensure compliance with KYC and AML regulatory requirements.

Outcomes

Netguru provided an extended team of experts who seamlessly integrated with FairMoney’s internal staff, contributing to key areas of the mobile app and delivering impactful results:

- Rapidly scaled the engineering team to align with FairMoney’s growth needs.

- Improved the app’s functionality across lending, banking, and KYC processes.

- Integrated identity verification and AML features to ensure compliance and enhance security.

- Accelerated development cycles, ensuring faster time-to-market for new features.

- Achieved an NPS score of 9, demonstrating high client satisfaction.

4. Moove: Building an App for Moove, the World's First Mobility Fintech

Moove, an African-born global start-up and the world’s first mobility fintech, partnered with Netguru to develop an all-in-one app designed for mobility entrepreneurs across nine African countries. The goal was to create a scalable solution that integrates financial and operational tools to support drivers in managing their businesses efficiently.

Objectives

-

Build a super-app MVP scalable across multiple geographies.

-

Provide drivers with functionalities like performance tracking, financial management, and customer support.

-

Ensure compliance with local financial authorities while accommodating diverse user habits and varying tech literacy levels.

-

Seamlessly integrate the app with Moove’s product ecosystem.

Outcomes

Netguru collaborated with Moove’s engineers to develop a fully functional MVP tailored to the needs of mobility entrepreneurs. This included:

- Delivering a scalable app architecture designed for expansion across multiple geographies.

- Creating functionalities such as KPI tracking, plan and vehicle details, Wallet integration for payments, and customer support access.

- Implementing an Agile, Scrum, and Lean Startup approach to optimize the development process.

- Launching the MVP for beta testing in Nigeria and scaling up based on user feedback.

- Providing comprehensive product, project, and technical artifacts, including roadmaps, infrastructure diagrams, and quality assurance reports.

5. Dock Financial: Accelerating KYC

Dock Financial, a leading provider of payment and compliance infrastructure, partnered with Netguru to develop a KYC tool for their platform. The goal was to ensure user verification, integrate with external KYC providers, and enable on-demand manual approvals while maintaining a secure and scalable architecture.

Objectives

-

Develop a KYC tool with API support for one-time user verification and reusable KYC profiles.

-

Ensure seamless integration with external KYC providers.

-

Expand functionalities to include Know Your Business (KYB) capabilities.

-

Address challenges around data confidentiality and security.

Outcomes

Netguru collaborated with Dock Financial to deliver a scalable compliance infrastructure, including:

- A functional KYC MVP with external integrations and customer communication capabilities.

- Expanded verification processes for natural and legal persons.

- Improved database architecture and API updates to support risk assessment.

- Ongoing support in DevOps, frontend development, and design.

6. Easy Online Payments With an App for a Payment Card Services Provider

Netguru partnered with a European branch of a payment card services provider to create a mobile application for iOS and Android. The goal was to introduce a secure, fast, and convenient phone number-based payment method to the Polish ecommerce market.

Objectives

-

Deliver a native mobile app for iOS and Android within strict security and usability standards.

-

Ensure seamless collaboration with stakeholders across multiple time zones.

-

Overcome challenges such as backend revamps, design changes, and stringent security requirements.

Outcomes

Netguru provided an expert team, including mobile engineers, quality assurance specialists, and project management professionals, to successfully deliver the mobile app:

-

Built a highly secure and performant app from scratch, meeting all client requirements.

-

Achieved over 50,000 downloads on Google Play as of October 2023.

-

Ensured accessibility compliance through extensive testing.

-

Delivered a seamless handover with a detailed action plan, tutorials, and documentation.

-

Maintained customer satisfaction with an NPS score of 9.

7. Solaris: Backend Solutions for Europe’s Leading Banking-As-A-Service Company

Solarisbank, a Berlin-based fintech offering Banking-as-a-Service solutions, partnered with Netguru to enhance its backend capabilities. The collaboration aimed to support Solarisbank’s rapid growth and ensure its customizable API remained secure and scalable, enabling seamless integration of digital banking services like payments, e-money, lending, KYC, and algorithmic scoring.

Objectives

-

Expand and enhance Solarisbank’s API services for third-party integrations.

-

Support backend development for products like debit cards and consumer loan engines.

-

Automate testing processes to enable continuous delivery.

-

Share best practices for managing remote-first development.

Outcomes

Netguru collaborated with Solarisbank to deliver backend solutions that fostered continuous growth and operational excellence:

-

Expanded API functionalities, enabling secure and scalable digital banking solutions.

-

Built a standalone team to develop the platform for handling debit cards using Ruby.

-

Strengthened the consumer loan product engine with Elixir development.

-

Implemented test automation, ensuring smooth operations for long-term projects.

-

Developed an API for Mastercard to support credit card management.

-

Automated client notification processes for negative account balances through the Dunning project.

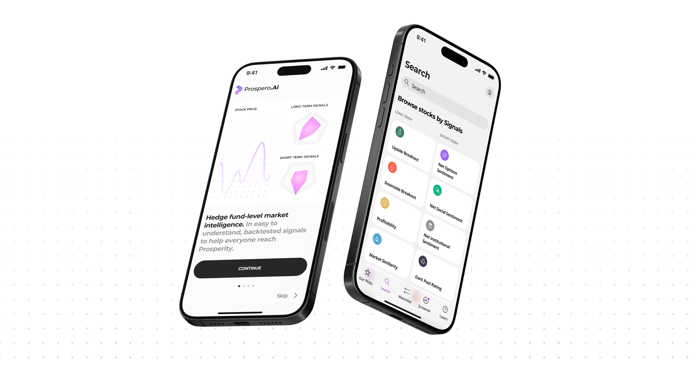

8. Prospero.Ai: Providing a Mobile App MVP in 5 Weeks

Prospero.Ai, a transformative New York-based fintech startup, partnered with Netguru to develop an AI-powered mobile app for iOS and Android. The platform was designed to democratize access to financial markets, offering actionable insights based on real-time data analysis.

Objectives

-

Develop an MVP with a redesigned user interface tailored to attract mainstream customers and simplify financial insights.

-

Integrate knowledge-sharing features to improve user engagement and education.

-

Ensure delivery within a tight 5-week timeline for a crucial conference launch.

-

Maintain high standards of performance, security, and accessibility throughout development.

Outcomes

Netguru successfully delivered user-friendly app for Prospero.Ai, achieving the following results:

-

Delivered the MVP within 5 weeks, meeting the crucial conference deadline and staying below budget.

-

Redesigned the user experience, making the app more accessible and appealing to mainstream users.

-

Developed a single codebase in React Native, ensuring efficiency across iOS and Android platforms.

-

Addressed critical usability, performance, and security issues overlooked by the client, ensuring a high-quality product.

-

Achieved maximum client satisfaction, reflected in an NPS score of 10.

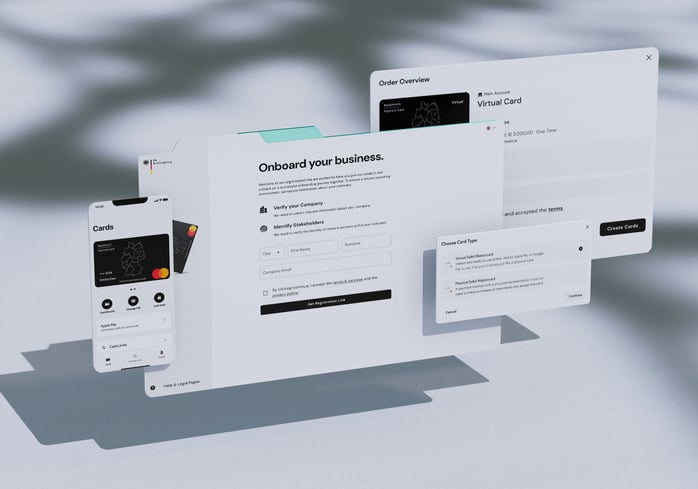

9. CashCape: Development and Implementation of Top Security Measures

CashCape, a mobile-first end-to-end loan broker focused on the German market, partnered with Netguru to develop and secure its fintech platform. The goal was to create a user-friendly app that simplifies loan access for young, tech-savvy users while maintaining full compliance with Germany’s stringent financial regulations.

Objectives

-

Build a secure, compliant app for processing short- and long-term loans.

-

Integrate with external providers, including licensed banks, for seamless loan approvals.

-

Implement top-tier security and identity protection measures.

-

Provide a scalable platform for future feature expansion and growth.

Outcomes

Netguru collaborated with CashCape’s team to deliver a high-quality, secure app aligned with the founders’ vision. The project achieved the following results:

- Developed a robust backend and frontend system with advanced security measures.

- Integrated with external providers to enable seamless data synchronization and compliance.

- Delivered a platform that allows customers to complete loan applications entirely online, including video calls and digital signatures.

- Ensured compliance with strict regulatory requirements, making the app suitable for the highly regulated German fintech market.

- Provided quality assurance support to optimize CashCape’s core processes and enhance user experience.

10) PAYBACK: Seamless User Interface for Customer Loyalty Apps

.jpg?width=700&height=489&name=Case%20study%20image%20Payback%201%20(1).jpg)

PAYBACK, the world’s largest loyalty program, partnered with Netguru to redesign their mobile and web applications. The goal was to simplify navigation, align visual content with corporate branding, and integrate new geolocation features, creating a more seamless and user-friendly experience for their millions of active users.

Objectives

-

Simplify and synthesize the interface for easier navigation across mobile and web platforms.

-

Modernize and unify the design of over 120 application screens to align with corporate branding guidelines.

-

Integrate geolocation features to provide additional value for partners and customers.

-

Enhance educational content to help users better understand the platform's features.

Outcomes

Netguru collaborated with PAYBACK to deliver a comprehensive redesign of their digital products over a six-month period. Key outcomes included:

-

Redesigned mobile and web applications with a more intuitive and user-friendly interface.

-

Unified the visual design of over 120 application screens, ensuring consistency across platforms.

-

Integrated geolocation features to enhance partner value and user engagement.

-

Developed educational content to improve feature accessibility for users.

-

Delivered all updates within the approved budget, ensuring no negative impact on PAYBACK’s 700,000 annual website visitors.

The Netguru Approach to Building Financial Products

Creating a successful fintech product isn’t about following a one-size-fits-all formula. Instead, it requires leveraging proven principles and adaptable frameworks that can be tailored to each project's distinct needs and goals. At Netguru, we combine strategic thinking with a flexible approach to ensure every financial product meets its unique challenges.

Key Principles

- User-Centric Design: As customers demand seamless and intuitive digital experiences, we design interfaces that prioritize usability, accessibility, and engagement.

- Agile Development: With rapidly changing technologies and regulations, our agile methodology ensures adaptability, faster development cycles, and reduced risks.

- Regulatory Compliance and Security: To combat growing cybersecurity threats and meet strict regulations, we adhere to frameworks like ISO 27001 and GDPR, ensuring secure and compliant solutions.

- Scalable Solutions: Whether launching an MVP or scaling to millions of users, we build products that grow with your business needs.

- Innovative Technology: From AI-driven personalization to blockchain and advanced data analytics, we integrate cutting-edge tools that align with industry trends and enhance efficiency.

We’ve applied these frameworks across dozens of projects for fintech clients. The result: shorter development cycles, streamlined processes, increased revenues, and new or strengthened products that have delivered measurable ROI.

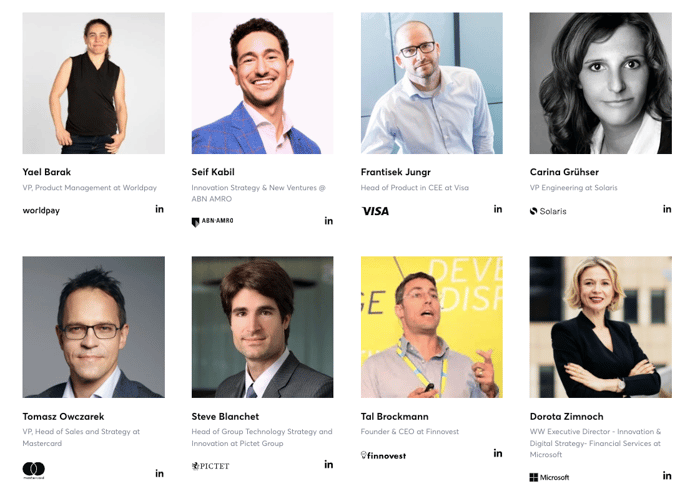

Building a Community for Fintech Leaders Through Disruption Forum Events

At Netguru, we foster collaboration and knowledge-sharing by building a community of fintech leaders through Disruption Forum events. These gatherings bring together top executives, innovators, and decision-makers to explore emerging trends, tackle industry challenges, and share actionable insights that shape the future of finance. For instance, in 2023 and 2024, we hosted:

Disruption Forum: AI in Finance | What’s Next?

Co-hosted with Moonfare, this event focused on AI applications in finance, including fraud detection, risk assessment, and personalized financial planning. Experts from Moonfare and Netguru shared real-world use cases and discussed how AI is reshaping the industry.

Disruption Forum: Future of Finance | AI-Powered Experiences

This online event gathered leaders from Visa, Microsoft, Solaris, and ABN AMRO to explore hyper-personalization, payment innovation, and globalized financial platforms. Attendees gained practical strategies for leveraging AI to transform financial services.

Why Decision Makers Participate in Disruption Forums

- Access to Expertise: Attendees benefit from insights shared by thought leaders at top organizations like Visa, Microsoft, and ABN AMRO, gaining a deeper understanding of the latest trends shaping the fintech industry.

- Opportunities for Networking: The forums provide a unique platform for connecting with fintech executives, product owners, and decision-makers from around the globe, fostering valuable professional relationships.

- Practical Knowledge: Participants gain actionable strategies and real-world use cases that help them navigate challenges and accelerate digital transformation within their organizations.

Conclusion on Fintech Case Studies

At Netguru, we’ve partnered with leading organizations to deliver impactful solutions like seamless payment platforms, enhanced mobile apps, and secure KYC tools.

With a focus on user-centric design, agile development, and scalability, we help clients navigate challenges, deliver exceptional user experiences, and achieve measurable growth.

Ready to build the next big thing in fintech? Explore partnership opportunities with Netguru and let’s create a product that drives your success.

.